Health Savings Accounts: Don’t Overlook as a Tax Savings and Wealth Building Tool

July 30, 2020

To Inform:

How many of us routinely consider the question each year “how much am I eligible to contribute to my IRA or Roth IRA?” Many of us do, as we want to save as much as we can for our retirement goals while accomplishing them as tax-efficiently as possible. How many of us ask the same question about contributions to a Health Savings Accounts or HSA? My guess is the number falls off considerably! Used properly, the HSA is a great way to potentially build tax-free wealth while making deductible contributions each year.

First let’s remind everyone on HSA eligibility. To be eligible to contribute to an HSA account you must meet certain requirements defined by the IRS, with the main ones being you are covered under a high-deductible health plan and are over the age of 18. Furthermore, if you are over the age of 65 you can still make HSA contributions provided that you have not yet enrolled in Medicare. An HSA can be opened through a bank, insurance company, or other provider, and can be funded by automatic payroll contributions or directly by writing a check.

Tax Savings

Once eligible for an HSA you can take full advantage by contributing the maximum allowed each year. In 2020 the limit is $3,550 for an Individual health plan and $7,100 for a Family plan (there is a $1,000 catch-up for those 55 and older). The amount you contribute becomes 100% fully deductible from that year’s income regardless of how much you earn (both Traditional IRAs and Roth IRAs have earnings limits for what is deductible or even allowed to be contributed).

Once you fund your Health Savings Account and a Qualified Medical Expense comes up – can you use the HSA ? YES! At any age and at any time you can use those funds that you already received a tax break for and take a withdraw tax-free! (Mine comes in handy particularly with my contact lens expense each year, but there are dozens of IRS qualified HSA expenses.) Notice there are no taxes or penalties for a qualified medical expense? There are only two ways taxes and penalties impede any withdrawals from a HSA: 1) If you are under the age of 65 and use for a non-qualified expense you are subject to a 20% penalty plus ordinary income taxes, and 2) If you are over the age of 65 and use for a non-qualified expense you are subject only to ordinary income tax on the withdrawal amount.

Wealth Building

Another intriguing part of an HSA is the investment opportunity to further build wealth. As discussed, an HSA allows the option of taking funds out at any point but doesn’t force you to take funds out like a Flexible Spending Account (FSA) or IRA required minimum distribution. All funds contributed and not withdrawn continue to benefit from the tax-sheltered growth of the HSA.

How do I invest the funds? Virtually all HSA providers have investment options to craft an investment allocation. Does that sound like something The Joseph Group helps their clients with? That’s because it is! This is yet another way we help build wealth for a purpose. Additionally, if the beneficiary is properly titled (see Wealth Notes from July 2, 2020 on “Is Your Estate Set Up for Success?”) the HSA can be passed onto a surviving spouse for him/her to continue as their own HSA.

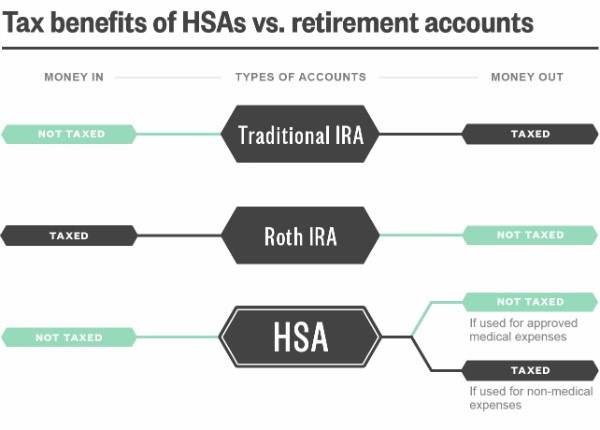

The chart below is a helpful reminder of the respective benefits an IRA, Roth IRA, and HSA Account offers. While we further discuss the purpose of your income, wealth, and overall wealth planning goals we are mindful to continue discussions that Health Savings Accounts can provide as an additional wealth solution. As many of you already know our mission is to help our clients live a “Great Life.” We are all trying to live this “Great Life” as tax efficiently and with as much investment savvy as possible!

Source: Reuters

This WealthNotes was written by Jeff A. Tudor, CRPS, Client Advisor