How Does the Make Up of This Year’s Stock Market Returns Differ from Last Year?

October 4, 2018

To Inform:

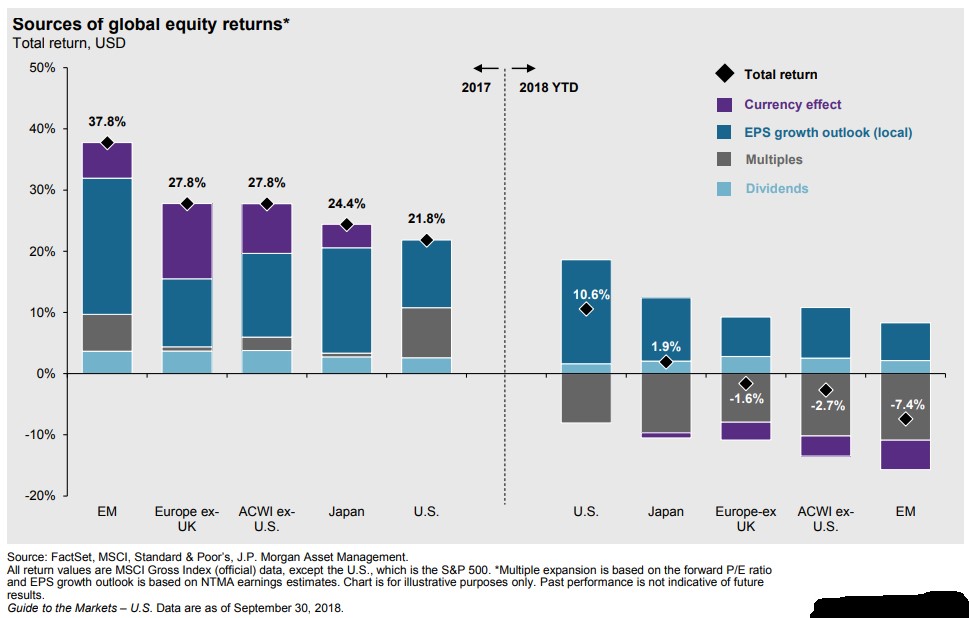

In 2017, global stock markets were firing on all cylinders. Earnings were growing, companies were paying dividends, prices were going up, and a weaker dollar even provided a tailwind for foreign stock returns. In 2018, returns in the global stock market have been harder to come by despite tax reform creating a boost for earnings here in the U.S. Looking globally, why are stock returns so much lower this year?

Perhaps it’s because we are investment nerds, but we find the chart below very informative. The chart compares stock market returns for different regions in 2017 with year-to-date 2018 and breaks those returns down into various components.

In 2017, foreign stocks, especially emerging markets, dominated and the stacked bars show why. Here is a breakdown of the left-hand side of the chart below:

- Dividends (light blue) came from all regions, but dividend rates are slightly higher overseas than in the U.S.

- Multiples (gray) are a fancy way of describing whether stocks are getting more expensive or less expensive. In other words, are investors willing to pay more or less for the earnings produced by companies in a region? Looking at the gray bars for 2017, multiples grew the most in the U.S. meaning U.S. stocks got more expensive relative to their earnings.

- EPS Growth Outlook (blue) simply refers to earnings. Earnings were terrific across the board last year but especially in emerging markets and Japan.

- Currency effect (purple) must be considered for us as U.S. investors when we are buying foreign stocks. Last year the dollar weakened, which meant that returns earned in foreign currencies bought MORE dollars when they were converted back to U.S. dollars. That provided an extra boost to foreign stock returns.

Overall, emerging markets were the place to be last year as earnings were strong. Also, because multiples increased LESS for foreign stocks than the U.S., on a relative basis, foreign stocks got cheaper compared to U.S. stocks despite their outperformance.

Source: JP Morgan Asset Management, JP Morgan Guide to the Markets

Source: JP Morgan Asset Management, JP Morgan Guide to the Markets

For the first nine months of 2018, there is only one area which has produced meaningfully positive total returns. Let’s dig into the right-hand side of the chart and look at why:

- Dividends (light blue) came from all regions, but dividend rates continue to be slightly higher overseas than in the U.S.

- Multiples (gray) have gone down across the board, specially in emerging markets. In other words, the prices investors are paying for stocks relative to earnings has gotten cheaper! This is important for the future outlook for stocks in general as valuations have gotten more attractive this year.

- EPS Growth Outlook (blue) – earnings have gone up across the board, especially in the U.S. The U.S. has received an extra boost this year from tax reform as the reduction in the corporate tax rate from 35% to 21% has provided a boost to earnings. While this is definitely positive and we have portfolios tilted toward the U.S., we do wonder whether the rate of earnings growth is sustainable in 2019 and beyond.

- Currency effect (purple) is negative this year as the dollar has rallied and returns earned in foreign currencies are converted back to more expensive dollars, thus resulting in fewer dollars. The currency component is always fickle, but we note the dollar stopped moving higher in September and research firms such as Goldman Sachs are calling for the dollar to weaken in the months ahead.

This year has been a struggle for diversified investors. While U.S. stocks have done well, falling multiples across the board have been a drag on global returns, especially for foreign stocks where falling multiples have coincided with headlines about tariffs. Looking forward, we draw a few conclusions:

- Earnings are positive globally and are estimated to continue to grow by double digits after 2018 in regions such as emerging markets. Falling multiples and rising earnings improves the outlooks for stocks in general and justifies and overweight stance.

- We question whether the U.S. maintains its earnings superiority going forward after the boost from tax reform fades. Considering foreign stocks have higher dividends and earnings are likely to grow at similar if not better rates than the U.S., staying global makes sense.

- The currency effect is always volatile, but multiple research sources we look at believe the dollar is likely to weaken after the mid-term elections. If that proves to be the case, the currency headwind will turn into a tailwind.

Have a great week!