How to Avoid Paying Too Much on Medicare Premiums

August 12, 2021

To Inform:

Are you starting Medicare soon or has your income changed significantly while on Medicare? If so, make sure that you’re aware of how your income affects your Medicare premiums. Most people know that taxes increase as income goes up, but many are unaware that Medicare premiums also go up with higher income. Fortunately, you have some power to influence your Medicare premiums.

What is IRMAA? How is it calculated?

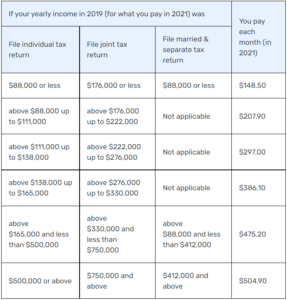

Most people pay a standard Medicare premium if their income falls below a certain threshold. However, Medicare bases Part B and D premiums on income from two years prior, which means that your 2019 income determines your 2021 Medicare premiums. If your income is higher than certain thresholds, then you will face an Income Related Monthly Adjustment Amount (IRMAA), which increases the amount you pay each month. If you are married and are both eligible for Medicare, this adjustment applies for both of you, which essentially doubles adjustment amount – ouch!

It’s important to understand where these income tiers happen to figure out whether or not this will affect you. Here is a chart of the 2021 Medicare Part B premiums based on income level:

Source: Medicare.gov

What can I do about higher Medicare premiums?

The first way to control Medicare premiums is to be aware of the ways that you can influence your income. After the age of 63 (assuming that you start Medicare at age 65), maximizing pre-tax contributions to retirement plans, IRAs, HSAs, and other tax-deferred vehicles can help to reduce your income below one of these premium thresholds. Additionally, Medicare premiums can influence other income accelerating strategies like Roth conversions or IRA withdrawals, making these strategies a little more expensive to execute. Keeping an eye on your overall income after age 63 can help to avoid any unexpected surprises from Medicare.

Secondly, if you fall into the category of people who had higher income while working, but now have lower income in retirement (or if your income has dropped significantly in retirement), then you can file an appeal to reduce your premiums. Medicare recognizes eight specific life-changing events that qualify for an appeal. Those eight events are:

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage (Retirement)

- Work Reduction (Partial-Retirement)

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment (if your employer went through bankruptcy or reorganization that caused your income to change)

How to file an appeal

You can file an IRMAA appeal by completing Form SSA-44 (https://www.ssa.gov/forms/ssa-44-ext.pdf). Many newly retired people over the age of 65 who begin Medicare immediately upon retirement will benefit from filing an IRMAA appeal, especially those people whose incomes were above the first Medicare premium thresholds ($88,000 for individuals and $176,000 for married filing jointly). Retirement is one of the most common life-changing events that qualify for a reduction of Medicare premiums.

Conclusion

Don’t let high Medicare premiums catch you off guard! Pay attention to your income and where it falls in relation to the Medicare premium thresholds, especially after the age of 63. If you experience a drop in your income after becoming eligible for Medicare, you can potentially save yourself thousands of dollars in premiums by filing an IRMAA appeal. Complete the Form SSA-44 or reach out to your financial advisor or health insurance agent for help.

Written by Jake Martin, Client Advisor