In Prosperity be Prudent, in Adversity be Patient

July 1, 2022

To Inform:

I was at flagship branch of Huntington Bank the other day and as I admired the ornate ceiling my eye caught an engraving above the entrance hall. The line, attributed to one of the sons of the bank’s founder is as follows: “In prosperity be prudent, in adversity be patient.” This quote is a wonderful reminder to us that life is a rolling series of prosperous times and times of adversity. Markets today clearly feel more adverse than prosperous. Investors facing down negative returns in both bonds and stocks may feel a little like Odysseus caught between the monsters Scylla and Charybdis. Odysseus escaped their clutches by clinging to a tree, waiting for Charybdis to release the remnants of his ship. In other words, he practiced patience.

What can investors cling to today while we wait for these adverse seas to clear? In the portfolios we have the privilege of managing on behalf of our clients we’ve been increasingly focusing on dividends. In times of prosperity, dividends aren’t glamorous. History is replete with examples of glamorous stocks leaving the dividend payers in the dust. The most recent episode was the mix of Covid lockdown beneficiaries (think of certain telework, telemedicine, streaming video, and home goods stocks) and internet “meme” stocks in late 2020 and early 2021 posting outsize returns that make things like dividends seem quaint.

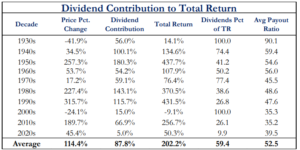

A simple review of history, however, teaches us that those sorts of times don’t always last. The chart below shows us the impact of changes in the earnings multiple (how much investors are willing to pay for a dollar of earnings) and the impact of dividends on total returns in US stocks going back to the 1930s. A few decades stand out as particularly “prosperous”. The 1950s, 1980s, 1990s, and 2010s. In those decades dividends accounted for anywhere from 26.1% to 41.2% of the total return in US stocks. The remainder can be attributed to expansion in earnings multiples. In decades where the contribution of the earnings multiple was either negative or only mildly positive, dividends accounted for much more of the total return generated by US stocks. Anywhere from 50% in the 1960s to 100% in decades like the 2000s or the 1930s.

Source: Strategas

My crystal ball is as fuzzy as yours, but my hunch is that the 2020s could be a decade where investors need to rely more on dividends as a function of total return than the continued increase in earnings multiples.

Companies that pay dividends tend to have higher quality balance sheets, generate significant amounts of cash flow, and are integral to our daily lives in some way. I recently had a conversation with a wholesaler for a large, storied asset manager that has long focused on value and quality. He noted that very recently the market cap of a large online retailer was greater than the aggregate of every energy company in the United States. He then asked what would happen if this particular retailer disappeared tomorrow. How much would I be inconvenienced? Only a little bit. My family would need to change some of our shopping patterns, but life would go on. He followed this question by what would happen if all of the energy companies in the United States stopped operating tomorrow. We all know the answer to that question. This is just one example of the importance of certain industries to our lives. A common theme across most of these types of industries that they can operate through good times and bad and have a history of rewarding shareholders with dividends.

The world today is a little more complicated, a little more challenging than it has been in the years of the last decade. Our goal is to acknowledge it, but then to move on and ask how can we navigate it. We think one of the answers is through exposure to dividend paying stocks. While not as fun as the shooting fish in a barrel feel of prosperous markets, an allocation here can allow patient investors to hold on for the eventual return of more prosperous times.

Written by Alex Durbin, Portfolio Manager