Inflation is Here – Will It Stick Around?

May 28, 2021

To Inform:

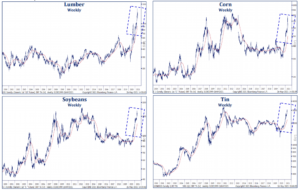

One of the biggest debates in the investment world is the future of inflation. There is no doubt inflation is here. So far in 2021, direct inputs to things we buy like lumber (think housing), corn/soybeans (groceries), and tin (cans for food, paint) have skyrocketed. The question though is whether inflation is a new structural reality or just a temporary phenomenon. Let’s look at the logic behind both views.

Source: Strategas Research Partners

View 1: Inflation is Here to Stay

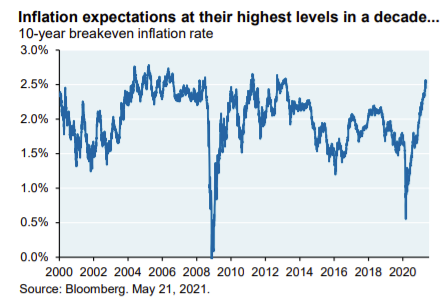

Future inflation expectations as measured by the market for Treasury Inflation Protected Securities (TIPS) are at their highest levels in a decade. The chart below shows TIPS are currently pricing inflation to average a little over 2.5% per year for the next 10 years.

Source: 361 Capital, JP Morgan

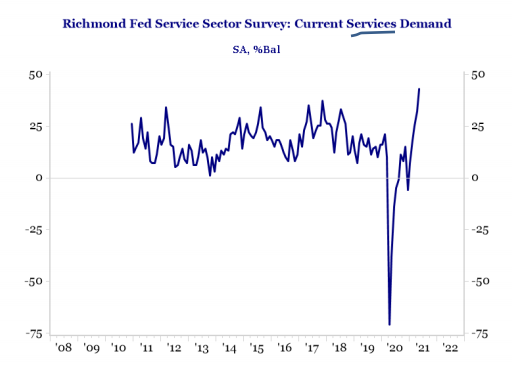

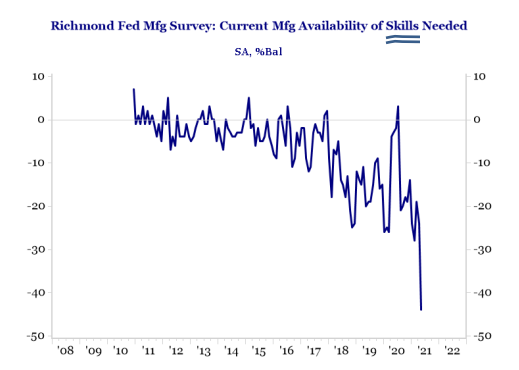

Economists on the side of “sticky inflation” acknowledge commodity prices may bounce around, but wage inflation is a sign of higher prices for the long term. As the economy recovers from the lockdown, demand is expanding but companies are struggling to find workers with the skills needed who are willing to work (see charts below from the Richmond Federal Reserve). Recent reports indicate firms across multiple industries including fast food chains, theme park operators, warehouse clubs, banks, and online retailers have been increasing wages in an effort to hire qualified workers. Theory would suggest as companies pay more, those companies will need to raise prices on goods and services in order to remain profitable, and the result is inflation which is here to stay.

Source: Strategas Research Partners, Richmond Federal Reserve

Source: Strategas Research Partners, Richmond Federal Reserve

View 2: Inflation is “Transitory” – We Only Reopen the Economy Once

Not everyone agrees that inflation is here to stay. According to research from Guggenheim Partners, “a closer look at the data suggests the spike in prices is a one-time adjustment as the economy reopens.” Gains in inflation gauges are largely being driven by “a few small categories and temporary pandemic induced shortages.” Most of the recent increase in inflation numbers came from used cars, rental cars, airfares, and hotels. Guggenheim believes these increases are unlikely to be sustained beyond the next few months, especially once prices in depressed categories recover back to the pre-COVID trend. Guggenheim goes on to suggest longer-term categories such as rent and health care costs are NOT seeing a similar spike in prices and those categories are much more important for the longer-term inflation outlook.

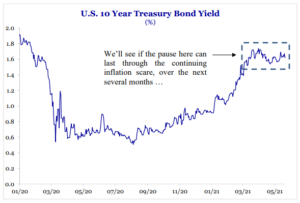

It’s worth noting while interest rates have risen year-to-date, the rate on the 10-year government bond has moved sideways for the last couple of months. Fears of skyrocketing inflation are typically accompanied by fears of skyrocketing interest rates and that’s not happening. Longer-term interest rates are merely back to pre-COVID levels. In other words, the bond market seems to be supporting the “inflation is transitory” camp.

Source: Strategas Research Partners

The View of the Fed Matters More than Who is Right

So, who is right? We would suggest a more important question is “what does the Fed believe?” Recent speeches by central bank officials have reinforced the idea that the pop in inflation is being viewed as transitory. Central bankers are aware of higher prices but the duration and composition of inflation is more important than the headline number. As long as the Fed views inflation has a short-term, under control phenomenon, then the Fed is likely to keep interest rates low and continue providing liquidity to the economy, which in turn is supportive of financial markets. If the Fed changes their view, they are likely to change their policies, and we believe that’s the biggest risk for investors. The good news is we aren’t there yet.

Written by Travis Upton, Partner, CEO and Chief Investment Officer