Innovation, Disruption, and What This Means for Markets

August 14, 2020

To Inform:

The words innovation and disruption seem to be getting used more and more around the investment world these days. This might spark a couple of questions. One being, “what does this mean for my investments?” and the other, perhaps, “is this anything new?” Before we answer, let’s define the terms. Innovation simply defined can mean “a new idea, method, or device.” Disruption is defined as “a disturbance or problem that interrupts an event, activity or process.” Innovation is indeed nothing new, nor is disruption. The pace and the magnitude of innovation and disruption, though, are worth paying attention to.

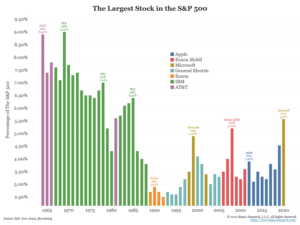

One trend in investing is the increasing rate of change in the country’s largest companies. Looking at the bar chart from Bianco Research, you can see that from the early 1960s till the late 1980s two companies battled each other for the crown of largest S&P 500 stock. In roughly the same amount of time, from the late 1990s to today, four stocks held the crown at one point or another.

Source: Bianco Research

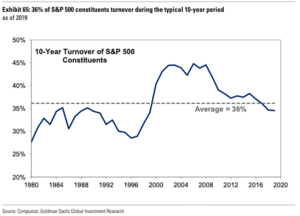

Looking under the hood, we can see stocks within the S&P 500 have turned over at a higher pace over the last 20 years than from 1980 to 2000. In other words, new companies have moved into the S&P 500 index while other companies have moved out at an increasing rate. Research from asset manager Franklin Templeton shows the amount of time a company spends in the S&P 500 has fallen from 33 years in 1964 to 24 years in 2016, with further declines expected. Innovation clearly isn’t new – there was tremendous change from the early 1900s to the middle of the century – but it certainly looks to be accelerating.

What’s behind all of this innovation and disruption? To really catch the attention of investors, innovation must be disruptive. A quick survey of the economic landscape reveals innovations in places like health care (gene therapy, gene editing), technology (artificial intelligence, blockchain, digital payments), and manufacturing (robotics, 3D printing, energy storage). Increasingly, these innovations are disrupting the established players in key industries, which in turn forces them to then innovate or be left behind. Think of electric cars. One manufacturer in particular has lapped the storied automakers of yesteryear (who will likely rise to the challenge). Gene therapy is another explosive innovation. The original cost of the Human Genome Project was in the neighborhood of $3 billion. Today, an individual’s genome can be mapped for just a few hundred dollars. These innovations, often having spent years in development are now being commercialized and in many cases are investable.

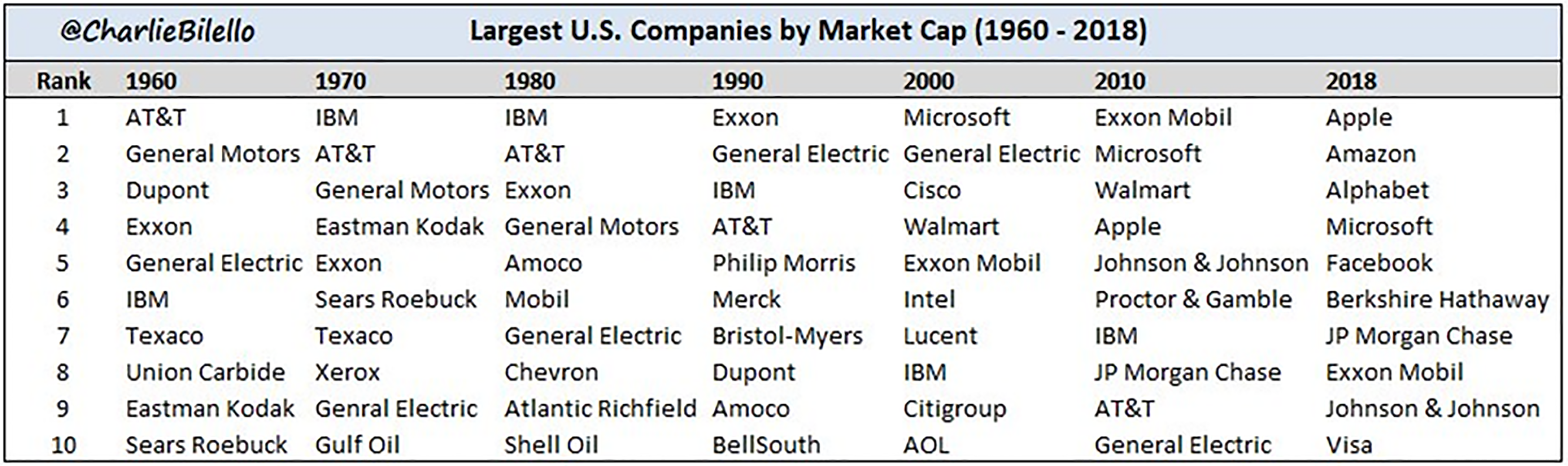

There are strong investment opportunities in recognizing these trends and sussing out the ones that are both meaningful and invest-able. Our goal is to do our research and partner with smart fund managers to participate in not only the improved standard of living many of these innovations provide, but their economic benefits as well. Innovation and disruption are not only changing the way we live, they are changing the investment landscape. As a result, the S&P 500 of 2030 will likely look much different than it does today.

Source: Charlie Bilello, Compound Advisors

As always, everything we do is designed to help our clients live their best life. We will keep sharing our thoughts and please reach out to us anytime with questions. Have a great weekend!

This WealthNotes Inform was written by Alex Durbin, TJG Portfolio Manager