Insights from a Future Fed Chair Candidate

December 5, 2025

To Inform:

I (Travis) recently had the opportunity to attend a conference in New York City headlined by Rick Rieder, Head of Fixed Income (Bonds) for BlackRock and a candidate who has interviewed with the President to replace Jerome Powell as Chair of the Federal Reserve.

Conference Photo

Rieder: “We have to cut interest rates.”

As a candidate for Fed Chair, Rieder believes the Fed should lower interest rates. Rieder believes “productivity is exploding” which is helping companies and corporate profits, but it also means companies can do more with fewer workers which is a drag on employment. Rieder pointed to forward looking inflation expectations which are under 2.4% and said “jobs are a bigger problem than inflation and we have to get rates down.”

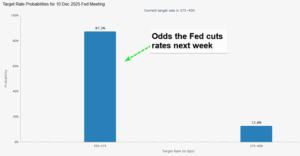

It is worth noting the Fed meets next week on December 10 and according to CME Fed Watch, Fed Funds futures are pricing in an 87% chance the Fed cuts by 0.25% on Wednesday.

Source: CME FedWatch

Rieder: “Tariffs don’t matter much because services dominate the economy.”

When it comes to tariffs, Rieder pointed out the larger U.S. economy is dominated by “services” such as health care, transportation, banking, arts, recreation, etc. Services make up over 77% of the economy while goods, where tariffs have the most impact, are only about 20%. Rieder suggests, “for the broader economy, tariffs just don’t have a big enough impact, and you are likely to see inflation stay under control.”

Rieder: “Stocks are likely to go higher.”

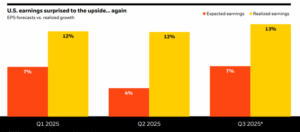

Although Rieder is a bond guy, he certainly put himself out there as a fan of the stock market. Rieder pointed to data showing that profit margins for businesses remain solid and (echoing a theme of The Joseph Group) corporate earnings are fantastic. As shown in the chart below, actual corporate earnings (yellow bars) have exceeded already high expectations (orange bars) for the last three quarters.

Source: BlackRock

As long as earnings remain strong, the stock market should have a solid fundamental underpinning. According to Rieder, “companies with vast rivers of cash flow is where we should have our canoe.”

Rieder: “For bonds, current rates are very good indicators of future returns.”

When it comes to forecasting future returns for bonds, Rieder was a fan of keeping things simple. The current yield on the 10-year Treasury bond is about 4.1% and intermediate term corporate bonds are paying about 4.5%. Math suggests forward returns on bonds will be close to those numbers, plus or minus a little for price fluctuations, so “maybe 3.75% – 5% is a good range for bonds looking out the next few years.” Rieder pointed out when starting rates are higher (as they are today compared to several years ago) volatility is lower. Rieder likes bonds because “the interest you can earn per unit of volatility is historically high which is good for investors.”

Polymarket probabilities point to the highest odds being on Kevin Hassett, current Director of the National Economic Council, as being the most likely candidate President Trump nominates to be the next Chairman of the Federal Reserve. That said, Rieder has interviewed for the role, his name is in the mix, and his thoughts on the markets and interest rates hold some weight. Overall, despite gloomy consumer sentiment, Rieder was optimistic for the outlook for financial markets. Rieder quipped, “companies are doing great right now – people, not so much.” The bottom line – things may not “feel” great in markets, but fundamentals remain strong.

Written by Travis Upton, Partner and CEO