International Stocks – Waiting for Godot?

June 25, 2021

To Inform:

The Samuel Beckett play “Waiting for Godot” centers around two men who are waiting for a man named Godot. The men spend the entire play waiting for Godot who, in the end, never does makes an appearance. As investors there can be periods where it feels like investing in a certain style or region feels a little bit like waiting for Godot. For investors in foreign stocks, this has certainly been the case. Since 2009, the S&P 500 has outperformed the MSCI ACWI Ex-US, an index of international stocks in 9 out of 12 years. Are investors waiting for international stocks as the two men in Beckett’s play wait for Godot, with no real chance of a payoff?

The most important factor in stock market returns at the individual company level all the way up to the level of a country or region of the world is earnings growth. Looking at the gold line on the chart of relative earnings growth between non-US stocks (MSCI EAFE) and US stocks (S&P 500), one can see that for much of the 2000s earnings growth in non-US stocks was occurring at a faster pace than US stocks. As a result, non-US stocks outperformed US stocks for much of this period (blue line). For much of the last decade, US companies have grown earnings at a much faster pace than non-US companies. Unsurprisingly, US stocks have outperformed over this time period.

Source: Western & Southern

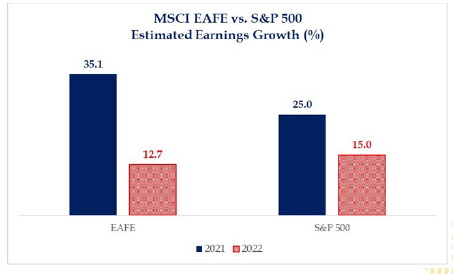

With this in mind, it isn’t unreasonable to ask if investors in non-US stocks are consigned to a fate of waiting for outperformance that never comes. We think the answer to that question is no. What investors who get caught up in only recent history might miss is that there are periods of time where the types of industries more common in non-US markets (financials, industrials, materials) grow at a faster pace than those in the US. We may just now be entering one of those periods. The chart below shows expected earnings growth in the MSCI EAFE and the S&P 500 over the next couple of years. In 2021 earnings growth in foreign markets is expected to come in at a higher rate than in the US, with 2022 earnings roughly in line.

Source: Strategas

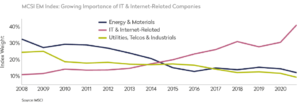

In emerging markets, the story could even be greater. The evolution in the key industries in emerging markets over the past decade plus has been nothing short of astounding. In 2008, energy and materials stocks represented over 30% of the MSCI EM Index. Today, that number is closer to 10%. Technology stocks have grown from around 10% to over 40% by the end of 2020. This change from resource-intensive, lower growth businesses to capital-light, cash flowing tech companies could bode well for investors looking beyond the US in the years ahead.

Source: Mondrian

Waiting out a period of underperformance in stocks is never fun. At best, it’ll force you to question your assumptions. At worst, it’ll force you into making a bad decision at what could be the very worst point in time. In portfolios we manage for clients we’ve allocated to managers who are focused on finding best-in-class companies outside the United States that have the ability to generate earnings and, ultimately, returns for shareholders. Unlike the men waiting for Godot, we think patient investors who allocate to these stocks will be rewarded for their patience.

Written by Alex Durbin, Portfolio Manager