Investing in Themes not Headlines

September 29, 2023

To Inform:

Following markets for the last 25 years, there have been a lot of flashes in the pan that have come and gone. You might be able to recall some of the companies which dominated headlines in the halcyon days of the Tech Boom. A select few may even remember the “Nifty Fifty” of the 1960s and 1970s! Many of these companies either went bankrupt or were bought for mere pennies and forgotten. The point I’m getting at is investing in “what’s hot” headlines is exciting but can be hard to get right. Investing in themes, however, can be a fruitful enterprise.

The Investment Strategy Team at TJG recently had the pleasure of hosting the Head of Thematic Solutions from an investment management firm we’ve known and followed for several years. Our discussion centered on themes (think: long-term trends) and how to think about and properly invest in them. To help the discussion, we explained to our guest how we think about themes at the Joseph Group and implement them in the client portfolios we have the privilege of managing. Our visitor then gave us a simple way of cutting through the headlines and the noise by explaining his way of thinking about themes. “The economy is going from A to B. We want to be invested in the things that will take us there.”

Why then is it hard to invest in themes and why is the investment landscape littered with craters of companies and investment managers who talk about the future “next big thing”? Our guest answered that question with another simple answer. “To invest in only one theme and get it right you must be a hero. Invest in several themes and your odds of success are much better.” Where we’ve seen the most trouble over the years is when investors narrow their focus to just one theme (this is the next big thing!), or a handful of themes which tend to move up or down in the same directions while paying no attention to valuations.

The solution, then, is to find themes that can be logically tied to a major shift in the economic landscape to satisfy the “get us from A to B” concept and are relatively uncorrelated. Our guest shared three themes he thinks are key to where the future economy is headed: automation and innovation, geopolitics, and demographics.

Automation and Innovation

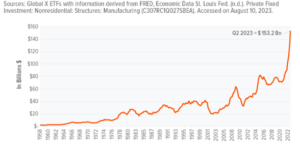

Drive almost any direction out of Columbus and it won’t take long to see automation and innovation in action here in Central Ohio. Numerous businesses are investing tens of billions of dollars in production capacity. And a lot of that capacity may not be people focused – it’s automation and innovation in the form of robots and machinery. A view we expressed early in 2022 in a Portfolios at Your Place call was that the 2020s would see the return of the real economy as companies manufacture and produce more things here in the US. The chart below from Global X puts into perspective this shift in manufacturing expansion, and therefore the expansion in automation and innovation.

Source: Global X

Geopolitics

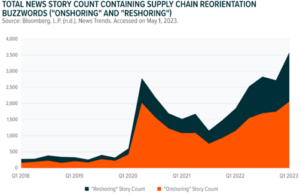

The shifting geopolitical landscape is certainly a big theme. After a 30-year period in which globalization was the dominant trend, a realization that the world isn’t as friendly or fair a place is kicking in. Many of us can think of towns here in Ohio that were hollowed out in the 1990s or 2000s by manufacturing jobs leaving the U.S. Today, it’s much more likely to see jobs coming back because of “onshoring” or “reshoring”. Global supply chains showed their weaknesses during COVID, and companies are rethinking the wisdom of locating all their production in faraway places. Just how dominant has this trend been? What we see in the construction data is backed up by what we’re seeing in the headlines. The chart below, also from Global X, shows the number of stories in the press referring to either onshoring or reshoring. From less than 500 a year in the late 2010s, the story count now is greater than 3,000 a year.

Source: Global X

Demographics – Retirement and Aging Populations

Finally, the idea of demographics being a theme is tied to a couple of trends. The accelerated retirements of Baby Boomers in the US is one of them, and falling birth rates and aging populations across the world is another. Aging populations and a smaller share of the population in their working years create pressure points but it also creates opportunities. Continued innovation in health care is essential. Also, a shrinking workforce will require increased productivity as companies seek to do more with less. Again, innovations in automation and robotics are likely winners here.

The way we’re thinking about and implementing themes in portfolios aligns with the idea of meeting clients’ long-term objectives. Whether it’s healthcare and cybersecurity in the Abundance portfolio or companies in Home Grown that are levered to the increased investment in automation in the US, we think the approach of investing in diverse themes that will take the economy from “A to B” is a recipe for success and avoids the pitfalls of investing in the “what’s hot” headlines.

Written by Alex Durbin, CFA, Portfolio Manager