Investing or Speculating?

March 24, 2023

To Inform:

Earlier this week, Travis and I had the pleasure of meeting with a fund manager we’ve known a long time who manages a global fund held in many of our client portfolios. The visit seemed particularly well-timed, as market participants obsess over Federal Reserve policy, bank stress, and other topics of the day. While we think those topics are important, hearing from a seasoned, long-time investor was music to our ears. There was great discussion about the history of financial crises and how this fund manager worked through those periods. In our conversation a couple of concepts stuck out to us that I think are worth sharing in a time like this. Perhaps the most interesting point he made was the distinction between investing and speculating.

One of our peers asked a question about his thoughts on value and growth investing. Considered a “value investor” the fund manager bristled at the idea that by being a value investor one is restricted to buying a handful of a certain type of stocks. He said his preferred way of dividing the world is between investors and speculators. Investors will scour the globe for businesses that are trading for less than their worth. This could be a traditional value stock (banks, oil companies, industrial companies) but it doesn’t have to be. There are certain times when a traditional growth stock (technology companies, for example) represents a tremendous value to an investor. Contrast that with the speculator who is playing the greater fool game and isn’t particularly interested in the companies they own. Here, one simply hopes to sell the stock later to someone else for more than what they paid. While I don’t find anything inherently “wrong” with this approach, I would prefer investing with someone who practices the art of investing – buying good companies cheap – than someone who is simply speculating.

This approach of investing in businesses is what makes a positive difference over the long term. Over the short term, it can be incredibly frustrating. In my conversation with this fund manager, he related to me his experience working at an investment firm owned by a French bank in the late 1990s. This particular firm was headed up by his boss, a world-renowned value investor who refused to cave to the investing fads of that day. Being owned by a large bank with certain expectations for generating profits, the investment firm only had so long a leash. As performance lagged their peers the bank grew frustrated. One of the board members went so far as to claim the investment firm’s leader was senile. His response? “I’d rather lose half the assets we manage than half my client’s money.” What a powerful statement!

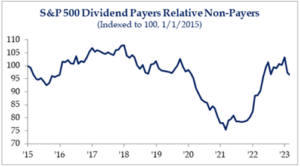

We see this happen on a regular basis. The investment world often feels like a game of tug-of-war between investors and speculators. Sometimes, speculators seem to be the ones having all the fun (remember “meme stocks”?). This is illustrated in the chart below. In the aftermath of the COVID economic shock speculators shunned high cash flow, dividend paying stocks for companies that looked to us as overvalued and risky. During this time dividend stocks massively underperformed non-dividend paying stocks. While not the be-all and end-all of investing, we think companies that commit to pay a dividend are more disciplined with the management of their business and were happy to remain invested. The market finally realized the intrinsic value of companies who pay a dividend as the trend turned in early 2021 and continued through last year.

Source: Strategas

We’re happy to sit on the side of the investors and hope you see the value in that too. We’ll never ignore the headlines of the day, but our goal is also not to forget the fundamentals of investing. Nothing is certain in the world of investing, but we believe a prudent approach is better than the alternative and would much rather concern ourselves with protecting capital than participating in the game of speculation.

Written by Alex Durbin, Portfolio Manager