Investing When Stocks Are Expensive

June 3, 2021

To Inform:

A sentiment we often hear is “I want to buy stocks, but I’m waiting for a pullback.” Another variation of this sentiment might sound like this, “I don’t want to buy stocks right now, the market is trading at all-time highs.” These are reasonable views. After all, it’s prudent to want to buy something at a discount. It rarely feels good to buy something at full price. The Investment Strategy Team often conducts a straw poll on how we feel about the various asset classes. Considering the recent performance of stocks (good), how the market “feels” about stocks (giddy), and valuations (full), the word that often comes up to describe our short-term view on stocks is neutral.

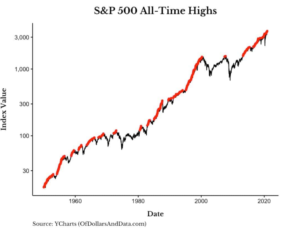

If you’ve tuned into some of our recent Portfolios at Your Place events, you’ll know that we’re positive on stocks over the long run. There are few better ways to ensure your purchasing power isn’t eroded by the ravages of taxes and inflation. It’s also no secret that stocks often trade near all-time highs.

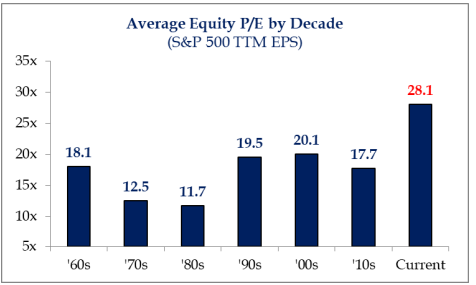

That said, we recognize that it is difficult to want to buy stocks after a 14-month period in which stocks appear to have gone parabolic. To put things in percentage terms, the S&P 500 is up over 87% since its March 2020 lows. If you’re like me, you’re wishing you had found some extra cash in the couch cushions to invest last spring. At these levels, stock valuations appear to be full. The accompanying chart of S&P 500 valuations is useful in that it shows us how rich markets are relative to history. While this chart seems to make stocks look especially expensive, other valuation measures show stocks to be merely expensive, but not historically so.

Source: Strategas

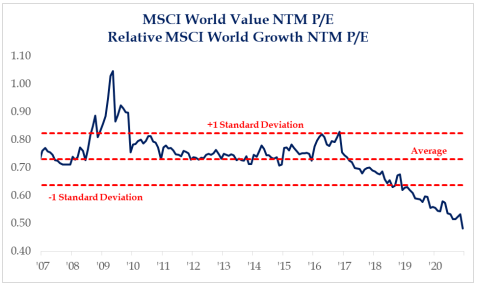

The way we’re “solving for” this challenge facing investors is to, as Willie Keeler the 19th century baseball player would say, “hit em’ where they ain’t.” Right now, that’s in places outside of the US and in value stocks. We’ve increased allocations in a number of client accounts over the last several months to these areas of the market. Value stocks, for example, almost always trade at discounts to growth stocks. What intrigues us is that value stocks are trading far cheaper than their normal discount to growth stocks, as shown by the graph below.

Source: Strategas

Outside of looking for areas of the market that are cheaper, we’ve also been relying more heavily on investment strategies that use options to protect investors against stock market selloffs while still offering upside potential in the event that stocks continue to go up. These strategies are designed to “reset” their options positions on a regular basis, allowing investors to continue participating in rising markets while at the same time increasing the price levels at which investors are protected from losses in the market.

Only time will tell whether or not stocks today are “expensive.” If they keep going up, they’ll have looked cheap, if we get a selloff everyone can say “I knew stocks were too expensive!” As best we can, we want to be positioned for either outcome.

Written by Alex Durbin, Portfolio Manager