Investment Manias

June 2, 2023

To Inform:

In his well-known book, Manias, Panics, and Crashes, late MIT professor Charles Kindleberger documents a series of, you guessed it, manias, panics, and crashes over a several hundred year time period. Kindleberger defines a mania as “a loss of touch with reality or rationality, even something close to mass hysteria or insanity.” He goes on to note that history is replete with manias – “canal manias, railroad manias, joint stock company manias, land manias, and a host of others.” Having dusted off Kindleberger’s book in recent days, I’ve begun to think about what “manias” we may be witnessing today.

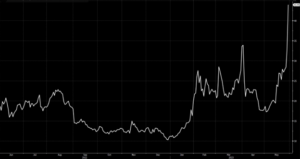

One of the more obvious manias is in the area of Artificial Intelligence. I believe that AI will certainly change things, perhaps much more than other recent innovations that have set the world into a mania (blockchain still hasn’t changed my life). That said, what will change? How will it change? When will it change? A lot of these questions are hard to answer this early in the game. That hasn’t stopped investors who are looking to benefit from the AI mania, er, boom. The chart below shows the last 12 months’ performance of a small cap company with AI in their name. The company isn’t profitable and has come a long way from its original objective of carbon capture (another mania?). Could it be that this time is different, and the company has earned a 4x return YTD? Or have investors put the cart before the horse?

Source: Bloomberg

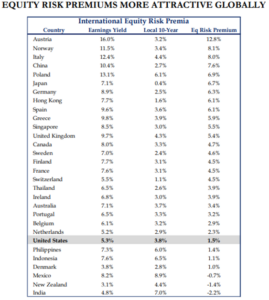

Another mania that may seem less acute than what we’ve seen this year with AI is simply the preference for US stocks over international stocks. A simple way of thinking about the relative attractiveness of stocks over bonds is to consider the “equity risk premium.” While this sounds complicated, it can be easily understood. You simply take the difference between the earnings yield on stocks (the inverse of P/E ratio) and the rate on 10-Year bonds. In the US, the earnings yield is right around 5% (the S&P 500 is trading at around 20 times earnings). Subtract the current yield on the 10-Year treasury, right now around 3.7%, and you have an equity risk premium of 1.5%. While this isn’t as bad as the negative equity risk premium (bond yields higher than earnings yields on stocks) seen at the peak of the Tech Bubble in March of 2000, it’s still well below the 20-year average of close to 2.6%. Eying the table below, even 2.6% seems paltry compared to premia seen in Europe and Asia. I don’t know when this gap closes, but it’s hard not wanting to own stocks in these other markets that offer a much more robust equity risk premium.

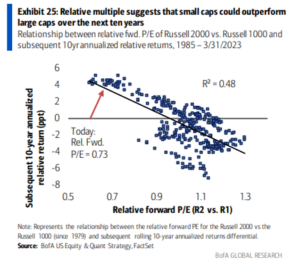

The final mania seems to be for large cap stocks, particularly in the US. In a reaction to a recent earnings report, the market bid up a well-known semiconductor company to a market capitalization of nearly $1 trillion, with a Price-to-Sales ratio of 38 times! Meanwhile, the market has left for dead wide swathes of the market, particularly in small cap stocks. The chart below shows the relationship between relative P/E ratios of small caps to large caps. While small caps often trade at discounts to large caps, rarely do they trade this cheap. Historically, when small caps have traded at these steep of discounts to large caps, they’ve gone on to outperform large cap stocks by wide margins over the ensuing decade.

Source: BofA Global Research

I’m hoping this tour of the manias du jour doesn’t come off as pessimistic. In fact, there’s great reason for optimism for investors who are willing to “pick their spots.” No one knows the time or the hour, but the adage “that which can’t go on forever, won’t” gives me confidence that eventually these manias burn out and the lesser loved areas of the market go on to reward investors. Kindleberger cites Isaac Newton’s experience with the South Seas Company in the 1700s. After losing an enormous sum, Newton was said to have claimed, “I can calculate the motions of the heavens, but not the madness of people.” A great way to avoid the regret of Newton is simply to not join the madness!

Written by Alex Durbin, Portfolio Manager