Irresistible Force Meets Immovable Object

January 17, 2025

To Inform:

Earlier this week, we hosted a Portfolios at Your Place event where Partner and CEO Travis Upton and Chief Investment Officer Alex Durbin captured five themes from the past and five new themes, all of which are relevant today. I would like to take this opportunity to focus on one of them titled, “Irresistible Force Meets the Immovable Object.”

As you may remember from WrestleMania III, way back in 1987, Hulk Hogan took on Andre the Giant in the main event from what was then known as the WWF Championship. The announcer at the time was Gorilla Monsoon, who quite possibly had the best quote in wrestling. He called the match “The irresistible force meeting the immovable object,” and that quote will be played in WrestleMania promos for the rest of time.

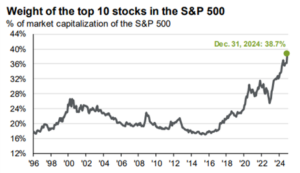

Similarly, two of the most powerful forces in finance, momentum and regression to the mean, have been in a battle for the past two years, and momentum is currently the reigning champion. Momentum in this case means assets such as stocks, that move in a particular direction, tend to keep moving in that particular direction. For example, for the past two years, large US corporates have dominated returns from the S&P 500, driven by what many in the industry call the “Magnificent 7.” They are the top seven stocks in the S&P 500, each of which has at least a trillion-dollar market capitalization. In fact, the top ten stocks now make up nearly 40% of that index, as can be seen in the chart below. As a result, the S&P 500 would not even qualify as diversified in many prospectuses.

Source: Morningstar

On the other hand, regression to the mean is also a powerful force. Regression to the mean is a fancy way of saying when it comes to assets such as stocks, what goes up, must come down, and vice versa. Think of the markets being stretched like a rubber band, and eventually, the market will snap back. At some point, all the other stocks in the S&P 500 will have their day in the sun, just like trees don’t grow all the way to the sky and footballs thrown in a perfect spiral eventually fall back down to the field. Value stocks, small and mid-cap stocks, and international stocks are all cheap and many asset classes currently have the biggest valuation gaps since the 2000s. Historically, regression to the mean happens – the question is always when.

Remember earlier when I mentioned that the top-ten stocks in the S&P 500 made up nearly 40% of that index? What if each of the 500 stocks in the S&P 500 had an equal weight in that index? That index would be called the S&P 500 equal weight index. As you can see in the chart below, over the decades, there has been a difference in returns between the S&P 500 market cap weight and the S&P 500 equal weight indices. Why is that important? In times of market extremes, you might notice that the S&P 500 market cap weight returns were much higher than the S&P 500 equal weight returns. For example, in the 2000 Tech Bubble, notice in the chart below that the markets were in a time of an extreme movement, which snapped back over several years after that tech bubble. We are in a similar situation today, where the S&P 500 market cap weighted returns have been much higher than the S&P 500 equal weighted returns over the past couple of years.

Source: Van Eck

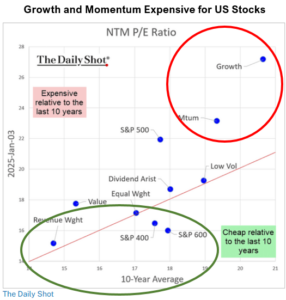

Another way of looking at how expensive some portions of the market are is by looking at Price to Earnings (P/E) ratios today versus the past ten years. For example, notice in the chart below that large-cap growth stocks (in the red circle, upper right) have had an average P/E ratio of about 20.5 over the past ten years, but as of 1/3/2025, have a P/E ratio of about 27. On the other hand, notice that the S&P 600, an index of small-cap US stocks (in the green circle, lower left), has had an average P/E ratio of about 18 over the past ten years, but as of 1/3/2025, has a P/E ratio of 16. This suggests that small-cap stocks are cheap relative to its history, and that large-cap growth stocks are expensive relative to its history.

Source: The Daily Shot

Will regression to the mean topple momentum as the reigning champion in 2025? The Joseph Group Investment Team wrestles with these ideas as we position the objective-based portfolios we have the privilege of managing for clients for success. Nobody knows for sure, but what we can say is that thoughtful analysis with a dose of humility leads to a diverse allocation to many asset classes, which tends to lead to more wealth preservation over time. This approach is better than putting all your eggs in one basket and hoping for the best!

Written by Jerry G. Brown, CFA, FRM, Senior Investment Analyst