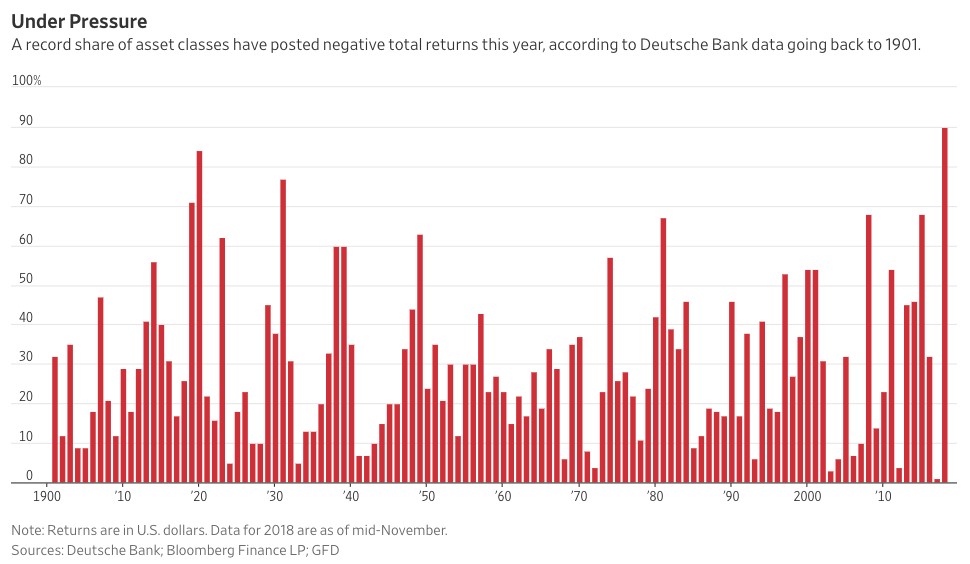

Is 2018 The Worst Investing Year in History?

December 13, 2018

To Inform:

The attention-grabbing headline was purposeful. Declines for major asset classes (like stocks and bonds) have not been especially deep in 2018, but when you look across asset classes, by some measures, markets have never seen a year where so many asset classes have negative returns.

A couple of weeks ago, the chart below was published in the Wall Street Journal. Out of 70 major asset classes tracked by Deutsche Bank (which includes stocks, bonds, gold, oil, and even burlap), 90% have negative YTD returns (through mid-November). The breadth of asset class declines is truly historic – the previous record, going back to 1901, occurred in 1920 when 84% of 37 asset classes were negative.

Source: Wall Street Journal, Deutsche Bank

Source: Wall Street Journal, Deutsche Bank

This chart, which we recently added to our Monthly Market Health Analysis packet, has sparked a lot of conversation among our advisors and clients. Here is a sampling of some of the questions we have received:

- What does this mean? In short, the data means diversified portfolios have struggled this year across the board. 2018 could be the first year in over 25 years that both global stocks and bonds finish the year in the red, and adding things like gold or real estate hasn’t really helped this year from a diversification standpoint. It also means this year is really odd – there is typically leadership somewhere across the financial markets, but it seems like the markets are going to take time to establish that leadership trend.

- If this is the worst year for asset classes, when was the best? Ironically, the best year in history was last year in 2017 when only 1% of asset classes tracked were negative.

- With so many asset classes being negative this year, is this indicative of a future recession or bear market? Even if you look at the chart, the big spikes are not clustered together. Using the previous example of 1920 as an example, in 1921 and 1922, over 75% of asset classes were positive, including stocks. If anything, lower prices (valuations) and higher interest rates actually make the prospect of future negative returns LESS likely.

- As an investor, what should I be doing about it? Although asset classes are broadly negative, for the most part, the declines are in the single digits and are not enough to disrupt a long-term investment plan. That said, do you know what your long-term investment plan is, or how different building blocks may come together to create that plan?

At The Joseph Group, for portfolios which seek to Protect or Provide cash flow, we are looking at lower bond prices as an opportunity to take advantage of higher interest and dividend rates. For portfolios looking to GROW or ASPIRE to higher levels of wealth, we are looking for opportunities created by areas where prices may have declined but earnings have not. We also believe market leadership will emerge – it is highly unlikely everything will continue to go down at the same time – and we want to make sure we are able to shift portfolios in the direction of that leadership.