Is the “Smart Money” Wrong?

June 30, 2023

To Inform:

Some of you may have attended TJG’s “Portfolio and Pints” hosted this week in our office. At the end of our presentation one guest asked an astute question about the “psychology” of the investor that is willing to look past some of the excesses in parts of today’s market and buy stocks given all of the continued negative headlines around markets and the economic outlook. Travis Upton, CEO/CIO of the Joseph Group, responded with a chart from Sentimentrader that we’ve often used to gauge sentiment in the market. The “smart money” (think large institutions) has largely been pessimistic this year, with the only peak in optimism occurring around the time of the bank failures early this year. The “dumb money” (think day traders, individual investors) has, for the most part been optimistic this year, with the most recent reading in extreme optimism territory. With the S&P 500 up a little over 15% this year, it seems like the dumb money has pulled a fast one over on the smart money.

Source: Sentimentrader

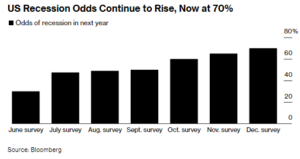

Why has the smart money been so pessimistic for so long? I think one clear factor is the idea that a recession was likely sometime in 2023. This idea began circulating early last summer and then reached a fever pitch last fall when bond yields spiked, and the S&P 500 hit a cycle low. Forecasters and economists were seemingly unanimous in their views that earnings would be rolling over in early 2023, that unemployment would begin to rise, that industrial production was going to plummet, and so on and so forth. In the United States, none of those things have happened thus far. This comes as a surprise to the economists participating in Bloomberg’s survey last December who, at the time, were predicting 70% odds of recession in the next year.

Source: Bloomberg

To be fair, none of these opinions were cooked up on a whim. There were very good reasons for these forecasts. Below is a chart from an economist published last December tracking the Conference Board’s Index of Leading Economic Indicators (LEI). Historically, when this index of composite economic data has gone negative year-over-year, recession has followed. This indicator turned negative last August. Now, 10 months out the economy remains in expansion. Only once in the past 50 years did this indicator take longer than 10 months to “call” a recession.

Source: The Macro Compass

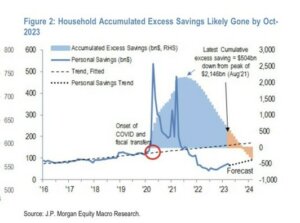

So, why has the recession and ensuing market selloff that many were forecasting failed to materialize? I would suggest jobs, pent up savings, and a less hawkish Fed have all acted to keep the economy out of recession. It’s really hard for an economy where jobs are plentiful and labor supply is tight to suddenly tip into recession. We’re seeing just how plentiful they are when continuing claims (people staying on unemployment) are falling at rates not seen since the early days of the post-pandemic recovery. As far as savings goes, US households still haven’t worked off excess savings that accumulated in the fiscal response to COVID-19, as you can see in the chart below. Finally, the Federal Reserve’s response to the banking failures in March reversed a trend of “quantitative tightening” that had been ongoing since 2021, easing pressure on banks and ultimately the broader economy.

Source: JPMorgan

So, where does this leave us today? Is the dumb money right? Well, they’ve certainly been right. We’re now halfway through 2023 and the majority of economists that were predicting recession late last year are on borrowed time. They may indeed end up being right, but one does question just how severe a recession one would experience with households in decent shape, demand for labor very robust, and a Federal Reserve closer to the end than the beginning of a hiking cycle. To us, this environment argues for a sense of calm. The sky may be a little smoky (thanks, Canada!) but it isn’t falling. Is the dumb money a little too exuberant? Perhaps, but it’s also the smart money is too pessimistic.

Written by Alex Durbin, Portfolio Manager