J.P. Morgan’s Wealth Management Conference Re-Cap

June 14, 2019

To Inform:

Earlier this week, I (Travis) attended J.P. Morgan’s Wealth Management conference in New York City. The two-day conference was an opportunity to hear the big picture outlook on markets from J.P Morgan’s Chief Global Strategist, views on asset classes from multiple portfolio managers, and perspectives on how firms like The Joseph Group can maximize retirement planning opportunities for clients.

Picture from the conference.

Picture from the conference.

I have pages of notes from the conference, but here are a few big takeaways as they pertain to investments:

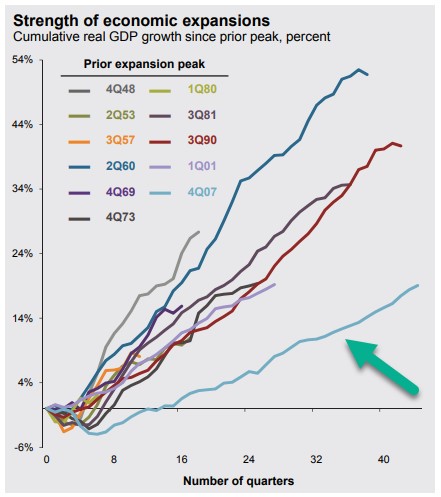

- 1. Global trade fallout is the biggest perceived risk to the economy, but there was not a lot of concern about recession. Trade and tariffs are clearly the wild cards portfolio managers thought represented the biggest risk to markets…probably no surprise there. However, despite talk of economic slowdown, there was not a lot of concern about a recession. J.P. Morgan’s Chief Global Strategist, Dr. David Kelly showed the chart below. In a few months, the current economic expansion will have lasted over 10 years and will be the longest expansion in U.S. history. However, the cumulative growth during the expansion has been the lowest of any expansion in the post-WWII era. According to Dr. Kelly, “growth in areas like housing and autos may be positive, but is well below average. It is difficult to hurt yourself too much jumping out of the basement window.”

Source: JP Morgan Guide to the Markets (arrow emphasis from The Joseph Group)

Source: JP Morgan Guide to the Markets (arrow emphasis from The Joseph Group)

- 2. No one is excited about bonds. There was a LOT of talk about the Federal Reserve and whether or not the Fed may cut interest rates in the months ahead. As one speaker put it: “late last year, the market thought the Fed would increase rates 3 times in 2019, and now the market is pricing in 3 rate cuts…the expectation was wrong then, and what makes you think is right now?” If the Fed doesn’t cut rates as much as the market expects, it implies interest rates are too low and bond prices might be too high. According to JP Morgan’s Chief Global Strategist, “if you are going to own bonds, be short duration and high quality…but for the longer term, with rates so low, stocks still seem to make more sense than bonds.”

Picture from the conference.

Picture from the conference.

- 3. There were mixed opinions on credit (high yield bonds). During one presentation, J.P. Morgan’s global asset allocation strategist talked about being “overweight” credit. Paraphrasing his reasoning, “High yield bonds are paying interest rates over 6% – that’s an attractive return compared to a choppy stock market which may move sideways given the trade risks.” On the other hand, another one of J.P. Morgan’s portfolio managers said he didn’t want to touch high yield bonds in his portfolio. Again, paraphrasing his comments:

“The investment banks don’t own the high yield bonds today, it’s all owned by retail investors who are chasing yield through index funds and ETFs. The money that came into the market fast will go out just as fast if we get into a slowdown. I can easily sell a high yield bond today, because everyone wants to buy it. You just aren’t getting compensated for the risk. I’ll gladly sell it to them now and keep some dry powder so I can buy the bonds back (at a higher interest rate) when everyone is running for the exits.”

It’s worth noting The Joseph Group is “underweight” relative to our own strategic allocations in credit, but it was extremely helpful to hear different perspectives, even within the same firm.

- 4. Now is not the time to give up on international stocks. One place where multiple portfolio managers did seem to agree is that the U.S. dollar is likely to weaken in the months ahead. If the dollar does weaken, it will be a tailwind to returns from foreign stocks. According to Chief Global Strategist Dr. David Kelly, “I know I have been talking about the opportunity in foreign stocks for a long time, but the pieces for outperformance are all there. Foreign stocks are historically cheap relative to U.S. stocks and they pay a higher dividend. You need to hold foreign stocks in your portfolio. If you combine the impact of 1) a higher dividend, 2) a move back to average valuations, and 3) a reversal of dollar strength, it is not unreasonable to expect foreign stocks to outperform U.S. stocks by as much 5% a year.”

Overall, the conference was a valuable opportunity to hear different perspectives as we seek to help our clients accomplish dreams and goals through the portfolios we manage.

Have a great week!