January’s Portfolios at Panera Discussion Recap

February 6, 2019

To Inform:

At last week’s Portfolio’s at Panera event, we asked the attendees to be Portfolio Managers for the morning. Each client/friend of The Joseph Group was given a worksheet and was asked if they were managing an investment portfolio, whether they would be “Overweight,” “Underweight,” or “Neutral” across four primary asset classes. The discussion that ensued was definitely lively. Here were the general results from the attendees:

- High Quality Bonds: Results were mixed with extremes on both sides. Some attendees wanted to play defense and load up on bonds to potentially protect against future market volatility. Others felt with interest rates still historically low, this was a time to avoid bonds and seek higher returns elsewhere. Bonds were definitely the most polarizing asset class for the group.

- Credit (Lower Quality, High Yield Bonds): In general, attendees wanted to keep High Yield Bonds at a neutral/underweight level with some discussion about concerns of the economy slowing later in 2019.

- Global Stocks: “Load the boat on stocks!” This was the area where attendees had the strongest opinions and virtually the entire audience said this was a time to be overweight stocks, particularly U.S. stocks. The discussion focused on an economy that still appears strong with stock valuations which appear attractive. Attendees of last week’s event were employed in various fields including commercial construction, the mortgage business, and medicine. All of them felt that based on what they were seeing, the economy remains strong and robust.

- Real Assets: Real assets focus on tangible assets you can touch and include things such as gold, commodities, and real estate. Convictions were not high in this area with attendees gravitating toward a “neutral” allocation. Within real assets, it was clear the group favored real estate over gold, oil, or other commodities.

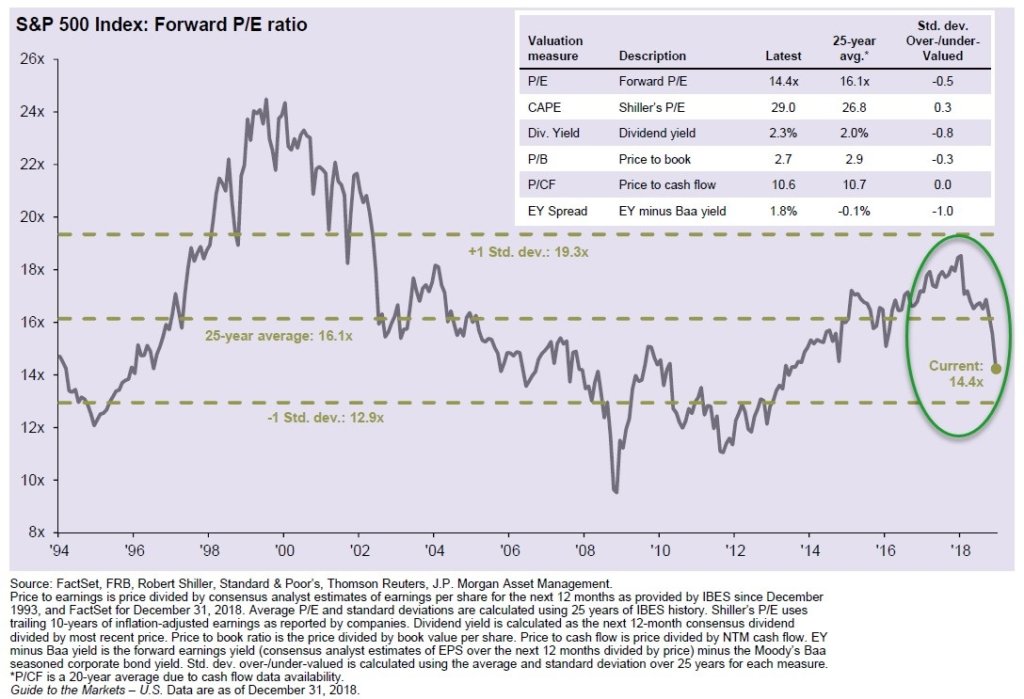

Bottom line: clients and friends who attended last week’s Portfolios at Panera event strongly favored stocks over any other asset class. One chart which supported the group’s opinion and got a lot of attention during the discussion is shown below:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

The chart shows that valuation for the S&P 500 based on the forward P/E ratio (S&P 500 index level divided by 2019 earnings estimates) was 14.4x times as of December 31. Even though stock prices were lower last year, earnings were actually positive – meaning the P/E ratio declined. The December 31st level of 14.4 is not only below its 25-year average of 16.1x, but it is also the lowest level the forward P/E ratio has been since 2014. According to the attendees, if you liked stocks the last 2-3 years, it makes sense to continue to like them today when valuations are cheaper.