Keeping More of What you Earn: The After-Tax Power of Direct Indexing

October 10, 2025

To Inform:

Many of us have heard the phrase, “control what you can control”. In many different aspects of life, this nugget of wisdom can help clear our thinking and direct our action. There are many things we can’t control when it comes to investing and financial markets. We are at the mercy of investor emotions, the business cycle, geopolitics, and a host of other things that affect financial markets. Despite this there are a good number of things we can control. We can control how we approach markets with respect to what types of assets we want to invest in. We can control our response to them in periods of fear or greed. We can also control to some degree how our investments impact our tax situation.

I recently spent a few days in Austin, Texas with an outside firm that operates a platform managing Direct Index accounts. This firm partners with firms like The Joseph Group utilizing a well-known tool in investment management known as a separately managed account (SMA). Investors who utilize a Direct Index SMA have the potential for greater influence and control over their tax liabilities.

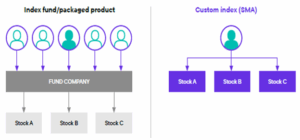

Instead of tracking a stock index through ownership of a mutual fund or ETF, a Direct Index SMA allows account owners to own stock in the individual companies that make up a stock index directly, instead of in a commingled fund or ETF managed by a fund company. The chart below highlights the difference between a fund or ETF and a Direct Index SMA.

Source: Canvas

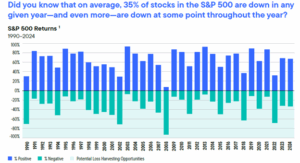

Why is this important? At its core, Direct Index accounts benefit from the volatility in individual stocks. The accompanying chart shows the number of stocks that are positive or negative in calendar years going back to 1990. On average, 35% of stocks are down in any given year. An even greater number may be down at some point during the year. Owning these stocks in a Direct Index SMA allows investors to take volatility – something we have no control over – and use it to their potential benefit by creating realized losses.

Source: Canvas

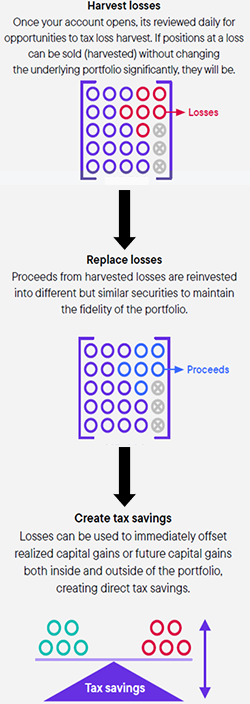

In a Direct Index SMA, because an investor owns most or all the individual stocks in an index, a Direct Index provider can seek to capitalize on the volatility of individual stocks and sell stocks with losses and replace them with similar stocks. This accomplishes two things: one, it allows investors to build a bank of realized losses, and two, it allows investors to maintain an account that behaves very similar to that of the index. A simple illustration of how this works can be seen below, with the small circles representing the stocks in a market index.

Source: Canvas

These losses can be used to offset gains in other areas of an investor’s portfolio or even on assets outside the stock market, perhaps a business or piece of real estate. In my meetings earlier this week, I learned that the Direct Index provider I visited now manages over $16B in assets on their platform, and that since launching in 2019, they’ve realizing over $1B in tax losses while still allowing investors to participate in the upward movement in US stocks over this time. This has created the potential for hundreds of millions of dollars in tax savings for investors who utilize the platform.

We’re excited about this potential at The Joseph Group. In working with a Direct Index provider, The Joseph Group can offer clients we have the privilege of serving another way to “control what they can control”. Of course, Direct Index accounts are not a one-size fits all solution, but we believe that for investors with situations that require some thoughtful tax planning, they can be a tool in helping achieve long-term investment objectives while doing so in a tax-efficient manner.

Written by Alex Durbin, CFA, Chief Investment Officer