Looking Back and Looking Ahead

December 12, 2025

To Inform:

This week The Joseph Group hosted clients and friends of the firm at our final “Portfolios and Pints” event of the year. As is annual tradition we looked back at the year and followed this with an update to TJG’s “Capital Market Assumptions.” That’s a ten-dollar phrase for “this is what we think asset classes will do over the next decade.” Why do we do this? Well, for one, we realize that financial plans aren’t written in months and quarters. They’re written in years and decades. Ultimately, we want to use the best research available to us to answer the question everyone is ultimately asking as it relates to their finances, “Does my plan work?”.

In looking back, it was nice to be able to have the benefit of hindsight and realize that financial markets weren’t collapsing in early April when the Trump Administration took a very different approach to trade policy than the last several generations of presidents.

Source: Yahoo!Finance

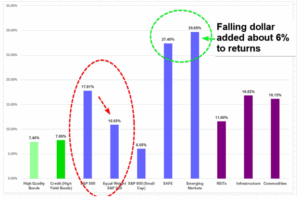

It turned out that 2025 (so far) has been a solid year for not only the S&P 500, but a host of different asset classes. As you can see in the table below, every major asset class (High Quality Bonds, Credit, Global Stocks, and Real Assets) was positive in 2025 through November 30th. For diversified portfolios, it was particularly pleasing to see non-US stocks working again, after underperforming US stocks for several years.

Source: TJG Global Investment Research

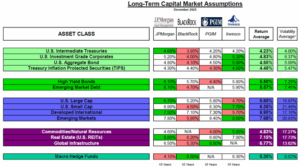

Recent performance is fun to talk about after years like 2025, but we think it is important to not be too focused on the rearview mirror. This is where our long-term capital market assumptions come in. The table below compiles the 10-year, annualized return forecasts across a range of asset classes used in TJG client accounts to reach financial goals. Using a range of large, well-respected banks and asset managers, we get an average return estimate for High-Quality Bonds, Credit (high yield bonds), Global Stocks, Real Assets, and Dynamic strategies (listed as macro hedge funds). To generate these forecasts, these institutions take all sorts of things into account, including economic growth forecasts, valuations, dividend yields, interest rates, currency movements, and inflation.

Source: TJG Global Investment Research

As you can see, forecasts range from the low 4’s for things like U.S. government bonds to more than 7% for U.S. Real Estate Investment Trusts. Will these forecasts be spot on? Of course not – we don’t expect them to be. What we do hope to get, however, is a reasonable range of outcomes that can give us confidence in the return estimates used for client financial plans.

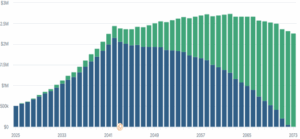

Advisors at TJG typically construct financial plans using a conservative return forecast of 4%. The thinking here is to be as conservative as we can to ensure that even in a low-return scenario, one’s financial plan can work. As you can see, none of the forecasts in the table above are below 4%. Many are above 5% or even 6%. While this difference may not sound large, the impact over the long term is substantial. The graph below shows a hypothetical financial plan for a couple aged 50. The next 15 or so years shows this couple continuing to save and grow their assets before retirement, at which point they begin to live off social security and their investment portfolios. The blue bars show what happens to their investment portfolio over time if they earn an annual rate of 4%. This couple doesn’t spend their investment portfolio down until reaching their mid-90s. Not bad. The green bars show the potential for their plan simply by adjusting the return estimate from 4% to 5%. In this scenario, the couple still has a sizable portfolio even into their mid-90s.

Source: TJG Global Investment Research

Our hope is that clients left this week’s event a little more confident that their financial plans are going to work. There will of course be ups and downs with markets, such as lean years (2022 being the most recent) and years of plenty (like 2025). But over a long enough period, we believe the tangible drivers of returns in bonds (income and interest rates) and stocks (earnings growth and dividends) will be what determines performance in those asset classes. Armed with that information and the forecasts we’ve compiled, we think clients can come away feeling confident in their financial plans.

Written by Alex Durbin, CFA, Chief Investment Officer