Looking Beyond Dividends for Return

August 27, 2021

To Inform:

When talking to people about stocks, the topic of dividends usually comes up. “What’s the dividend?” is usually the question being asked, and it is a reasonable one. Dividends are tangible ways for investors to understand that owning stocks is a claim on the cash flows of a business. That being said, paying dividends is just one of the many things companies can do with the cash flow their businesses generate. Other uses of this cash include reinvestment in the business, paying down debt, mergers and acquisitions, and buying back stock. The latter option, combined with dividends, can be combined into a measure known as “shareholder yield.”

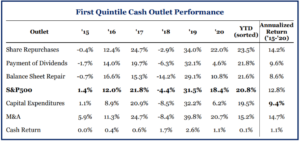

When looking at individual stocks we think it’s worth digging a little deeper than just looking at dividend yield to find companies that are returning cash to shareholders. The table below shows the performance of the top 20% of companies in the S&P 500 across the cash outlets I highlighted above. While the companies in the top 20% of dividend payers logged a respectable 9.6% annualized return from 2015-2020, they lagged the S&P 500 by over 3% annualized. The top 20% of share repurchasers (companies buying back stock) outperformed the S&P 500 by almost 1.5% annualized. The difference between the two was almost 5% per year!

Source: Strategas

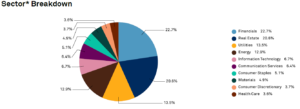

One reason for the performance disparity is that investing only in high dividend yielding stocks can lead to overweighting sectors of the economy that, while steady, historically have grown earnings and cash flows at much slower rates than other sectors. A look at the S&P 500 High Dividend Index highlights how significant this bias can be. Information technology stocks, close to 30% of the S&P 500 Index, only comprise 6.7% of the S&P 500 High Dividend Index. Underweighting technology stocks should be exercised with caution, as many technology companies are some of the highest “shareholder yielding” companies in the S&P 500.

Source: S&P Dow Jones

It helps to think like an owner when considering the impact of stock buybacks. As a stock holder, you own part of a company. When the company’s leadership decides to buy back shares on the open market your stake in the company grows, assuming you continue to hold the stock. As the company continues to generate cash flows your claim on those cash flows is now bigger than it was before the buyback. A company we hold in client accounts in our Home Grown strategy plans to buy back nearly 20% of the companies shares outstanding in the next year. The impact that has on an individual stock holder’s stake in the company is profound! Needless to say, we’re excited about that company and pleased to hold it in client portfolios.

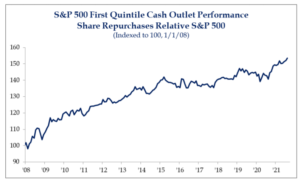

Owning companies that are wise with their use of cash, whether it be through the payment of dividends, share buybacks, or the other uses mentioned is key to building wealth. While it takes a little bit more leg work, it’s well worth the exercise. This final chart shows just how powerful this impact can be over longer periods of time.

Source: Strategas

Since 2008, the top 20% of highest share buyback companies have outperformed the S&P 500 by almost 50%. When you consider the S&P 500 is up 300% since 2008, that’s a pretty good deal.

Written by Alex Durbin, Portfolio Manager