Market Leadership Rotation

February 6, 2026

To Inform:

Earlier this week I had the opportunity to attend a meeting of a group of astute investors who run an investment partnership. After enjoying fantastic food, we started reviewing the holdings in their stock portfolio and made an interesting observation – the stocks which had been the leaders in the portfolio last year (think big technology stocks) were not the leaders so far in 2026. Instead, stocks which didn’t do as much last year (think small banks and energy companies) were the current leaders in the portfolio.

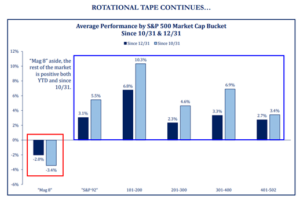

We are seeing this shift in leadership play out in the broader market. The chart below breaks down the 500 stocks in the S&P 500 by size. Year-to-date and over the last three months, the largest 8 companies in the index (which makes up about 35% of the index) have been negative, while the other 492 stocks in the index have had positive performance.

Source: Strategas Research Partners

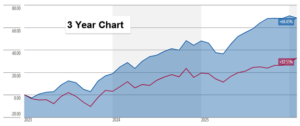

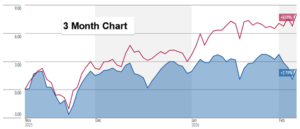

In past WealthNotes we’ve discussed the difference in performance between the mainstream, size-weighted S&P 500 (where the ten largest stocks make up close to 40% of the index) and the equally-weighted S&P 500 which takes all 500 companies and gives them an equal weight of 0.2% each. In the two charts below, the blue area is the mainstream S&P 500 while the red line is the equally weighted version.

Over the last three years, the mainstream S&P 500 has significantly outperformed the equally weighted version of the index as big technology stocks have dominated.

Source: Morningstar

More recently, over the last three months, we’ve seen this relationship reverse as the “rest of the market” is outperforming.

Source: Morningstar

What does all this mean for portfolios? As I type, the year-to-date performance of the S&P 500 is slightly negative at -0.6% through February 5th. However, clients may be pleased to know portfolios are broadly positive as dividend paying stocks, small company stocks, and foreign stocks have provided market leadership.

Looking at the headlines, it may “feel” the market is struggling, and it’s true some of the biggest companies are. But if you look a little deeper, more stocks are actually up than down as we start 2026.

Written by Travis Upton, Partner and CEO