Market Responding to ‘Better’ Trade News

May 9, 2025

To Inform:

A few weeks ago, we wrote in this space the importance of distinguishing “good/bad” from “better/worse.” The market, a forward-looking indicator, isn’t so much concerned about the current state of corporate earnings or the macroeconomic backdrop in general as it is the trajectory of those things. In early April, economic indicators were (and remain) quite solid. Employment was high, jobless claims low, and a host of other “hard data” measures were looking fine. None of that mattered in light of the news concerning tariffs as the market was discounting the impact tariffs would have on the economy in the short run. Our advice was to consider the possibility that all the “worse” was simply the spinach that comes before the candy. If we could digest the spinach of tariffs and perhaps move away from the most aggressive scenarios, this “better” news could help the market put in a bottom.

Since then, the market has continued to recover as more candy has been delivered to investors than heaping scoops of spinach. The most recent bit of candy was the announcement of a trade deal between the US and the UK. This deal keeps in place the 10% baseline tariffs but does away with the more severe proposals detailed on April 2nd. The deal eliminates tariffs on US agricultural exports to the UK, while allowing for UK autos to be exported to the US up to a cap. Frankly, the size of this trade deal is insignificant, a rounding error. What it signifies, however, is that the administration is willing to deal.

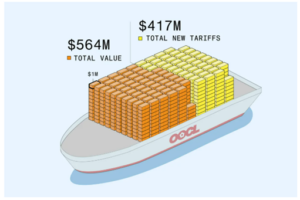

A willingness to deal is important because the elephant in the room, China, is set to begin talks with the US this weekend. Despite some exemptions, trade with China has been severely curtailed. Politicians from both sides of the aisle agree that China has in place several anti-competitive practices when it comes to trade with the US, but the integration of Chinese exports into the US economy is so significant that a “rip the bandaid off” approach is very difficult to do. A recent example is the story of the OOCL Violet, a container ship that was loaded before April 2nd. At the time, tariffs on Chinese goods were 20%. When the ship made port at Long Beach, tariffs had risen on some goods to 145%. The estimated tariffs on goods on board valued at an estimated $560 million ended up at over $400 million. Tariffs and a harder line against China aren’t going away, but any de-escalation from these levels would be considered as candy by the market.

Source: Bloomberg

The other major source of candy we talked about was the potential for movement on a pro-growth tax bill. A research firm we follow and respect referred to movement on a tax bill as crucial to “sterilize” the near-term negative economic effects of tariffs. Here, movement has been less meaningful. It is much easier for the president to decide what is and isn’t ok as far as trade deals are concerned, it is much more difficult to get Congress to agree on something as complex as tax policy. Major items being discussed include 100% expensing of capital goods and shortened depreciation schedules for major investments.

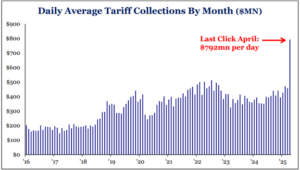

Part of the challenge in getting a tax bill through Congress is the great question of, “how are we going to pay for it?” The good news there is that the US has a growing source of revenue: tariff collections. Regardless of mine or anyone else’s opinions on tariffs, the one thing that can’t be disputed is that they do increase revenues to the US treasury. As of April, tariff collections totaled nearly $800 million a day. Extrapolating this to an annual number and one very easily can come up with around $250 billion or more in government revenues.

Source: Strategas

The likelihood that we remain in a news-driven market that trades on “better/worse” is high. There are simply too many unknowns and too much potential for change in the coming weeks and months. Our approach in this environment has been to not get carried away with either the rosiest assumptions or the most pessimistic predictions. We have taken the advantage of recent volatility to harvest tax losses in many accounts we have the privilege of managing. The lens through which we view every bit of news – good, bad, or ugly – is the objectives-based lens that guides the construction of investment portfolios. Here, we are confident that a steady approach with an eye on the goal but an ear to the ground is the right way to go.

Written by Alex Durbin, Chief Investment Officer