Market Wisdom from Willie Nelson and Waylon Jennings

May 30, 2025

To Inform:

One of the greatest country songs put to vinyl was a collaboration between Waylon Jennings and Willie Nelson titled “Mamas Don’t Let Your Babies Grow Up to be Cowboys.” My favorite line in the song is “He ain’t wrong, he’s just different.” There are some things about our philosophy here at TJG that we believe “ain’t wrong, just different.” One of those differences is our approach to asset allocation. Conventional wisdom in a lot of financial circles is that a simple mix of stocks and bonds is enough to call it a day on asset allocation and investors can move on to solving their next set of problems. But is the conventional wisdom right? Is there a path that “ain’t wrong, just different” that can still help investors reach their goals but sidestep some of the risks in following the conventional wisdom?

We think so. It is this belief that drives our philosophy towards asset allocation in our Provision and Harvest portfolios. While we believe there is a place for both stocks and bonds in those portfolios, we also believe that there is power in taking a slightly different approach. One major component of this different approach is our use of what we call “Dynamic” funds.

A fund in the “Dynamic” sleeve of these portfolios can employ a host of strategies. In the Provision portfolio it could be a strategy that is run by managers using their best ideas to generate income and capital appreciation while managing risk on the downside. It could be a strategy that captures the well-known “arbitrage” spread between companies being acquired and the companies doing the acquiring.

In Harvest portfolios, the types of Dynamic strategies look different because the objective is different. We define Harvest as a portfolio designed for “growth towards a specific goal” and, while still a factor, place less of an emphasis on income and risk management. Here you may see funds that again are “best ideas” portfolios run by managers who have a similar goal for their funds as we do for clients invested in Harvest. You may see funds that can invest both long and short individual stocks, buying the most attractive companies they follow and selling short the companies they find least attractive. Another fund we’ve long used is a “hedged equity” strategy that owns US large cap stocks but uses options to hedge against the risk of a market decline.

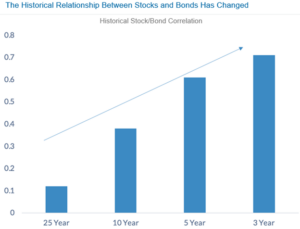

So, why do we do this? Is this any different than owning stocks and bonds? We recently had a discussion at TJG’s monthly Investment Committee meeting and spent some time on the why behind these Dynamic funds. One reason discussed for differing from the conventional wisdom is the shifting performance dynamic between stocks and bonds. The chart below highlights how similar these two asset classes have behaved over history. Over the last twenty-five years, stocks and bonds have displayed almost no correlation, a geeky word for similarity of returns. What this means in practice is that the two assets were good diversifiers for objectives-based investors. More recently, the similarity of returns between stocks and bonds has risen to around 0.7. A number close to 1 (perfect correlation) implies that stocks and bonds over the last three years have often moved in the same direction. In practice, this means a diversified portfolio isn’t very diversified! When stocks are going down investors expect bonds to cushion the shock. We think in extreme scenarios this is possible, but even in the month of April when stocks were selling off so too were bonds.

Source: RS Capital

Our use of Dynamic funds is our best attempt to position portfolios to deliver on their objectives should the conventional wisdom be wrong. We’ve seen this play out in risky environments like 2020, 2022, and the first few months of 2025. Our view is that at best, this could result in better returns over the long-term than owning a mix of just stocks and bonds. But even if this approach gets client portfolios to the same place, they would’ve gotten by using a simple mix of stocks and bonds but offers a smoother ride along the way, there’s some value in that too. This approach we believe “ain’t wrong, just different,” but unlike the cowboy in the song, we think portfolios that use Dynamic funds are both easier to love and a lot easier to hold!

Written by Alex Durbin, CFA, Chief Investment Officer