Navigating the Soft Patch

November 14, 2025

To Inform:

Markets have surpassed most people’s expectations this year. In the immediate aftermath of the April tariff announcements, many economists were predicting a recession and with it, poor stock market performance. With the gift of hindsight, we can see where those predictions went wrong. The tariff announcements proved to be a starting point in negotiations, albeit an aggressive one. This kept the hounds of recession at bay. The stock market, of course, has done well on the back of better-than-expected earnings growth in the US in 2025.

Now, though, there seems to be another disturbance in the force. Anecdotally it could be that you’ve heard of a recent college graduate having a hard time finding a job. Maybe a favorite restaurant closed. Perhaps you’ve seen the articles that auto repossessions are at multi-year highs.

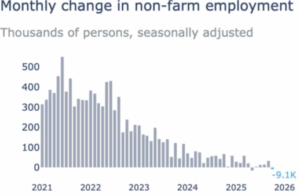

These anecdotes are borne out in the data. There’s no denying it; we’re in a soft patch. Non-farm payroll growth in the US has decelerated meaningfully, but our estimates as to how much are hampered by the only recently ended government shutdown. Economists and investment strategists are having to rely on data from non-conventional sources or private sources, like the research firm Revelio Labs who compiled the chart below.

Source: Revelio Labs

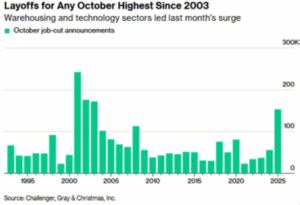

Not only has job growth been hard to come by, but layoffs are ticking up. Challenger Gray found that layoffs announced in the month of October are at levels not seen in over 20 years.

Source: Bloomberg

What might be causing this? The slowing trend in job growth isn’t new; it’s been going on for months now. An uncertain business environment in large part as a result of a changing tariff landscape has made it difficult for businesses to plan and invest. Still somewhat restrictive short-term interest rates maintained by the Federal Reserve are also contributing to a sluggish hiring environment, particularly for small businesses which, according to the US Treasury Department, employ 50% of all workers in the US. A couple of catalysts we’re watching that signal help may be on the way include a mix of upcoming policy and monetary development.

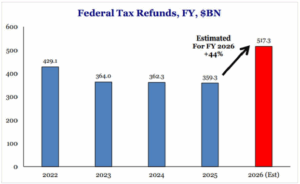

Let’s start with the most obvious catalyst, and that is the upcoming tax season. Federal income tax refunds are estimated to total more than $500 billion in 2026, an increase of over 40% relative to 2025. This will put cash in the pockets largely of the group who needs it most, those at the lower end of the income distribution. Since this group is one where we’ve seen a lot of the worrying headlines lately, we view this as good news.

Source: Strategas

Another upcoming catalyst is the ongoing lowering of the Federal Funds Rate. Despite some recent headlines indicating the Fed aims to be more cautious in their next meeting in December, sending odds of a cut next month lower, we think the market is overreacting. The Fed will begin getting visibility into economic data again, and recent reports continue to indicate that inflation is getting closer to the Fed’s long-term target. A continued lowering of the Federal Funds Rate is likely to ease the borrowing cost burden being shouldered primarily by small businesses.

In sum, we think an economy that is getting more clarity on things like tariffs, that sees more cash in the pockets of lower income workers, and an easing borrowing environment for small businesses is one that can navigate this current soft patch. Should this materialize, we think it is likely that we’ll see an improvement in the currently low level of consumer confidence and continued strength in US markets.

Written by Alex Durbin, CFA, Chief Investment Officer