Notes from the Field: Portfolio for the Future

September 2, 2022

To Inform:

Wednesday night I attended the programming season kickoff event for the Columbus CFA (Chartered Financial Analyst) Society. I had a front row seat for a panel discussion concerning “The Portfolio for the Future.” Panelists included the President/CEO of an institutional asset manager, the CEO/CIO of a local Private Wealth Firm and senior investment professionals representing fixed income and private debt. The event was moderated by CAIA (Chartered Alternative Investment Analyst) Managing Director Aaron Filbeck, CAIA, CFA, CFP CIPM, FDP. If that name sounds familiar, it’s because Aaron started his career as part of the investment team at The Joseph Group. I scribbled down notes throughout the event and thought I would share some of the highlights.

Source: CFA Columbus

The Future Looks Different than the Past

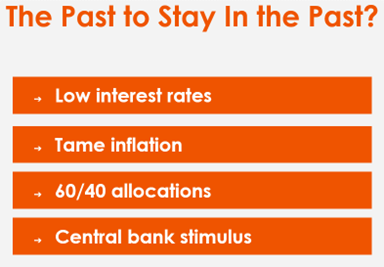

The beginning of the event framed the situation – the future is going to look different than the past – and therefore, the investment portfolio of the future may need to look different. The slide below illustrates what investors have experienced the past couple of decades…and suggested these factors no longer reflect the current environment.

Source: CAIA Association

When we look ahead, interest rates are rising, inflation is higher, Central banks such as the Fed are pulling away stimulus, and the traditional 60/40 stock bond portfolio which performed well in the previous environment may not get it done.

The Portfolio of the Future May Need to More Diversified

The point here is relatively simple. Since there are key differences between the future and the past, investors may need different tools to navigate the new environment. A robust discussion ensued about the role of different asset classes including commodities, real estate, and infrastructure as well as the use of different strategies which can mitigate volatility and take advantage of today’s environment. The result is a portfolio which may be less dependent on traditional stocks and bonds and has exposure to to wider mix of asset classes.

Volatility Presents Opportunity

When markets are volatile (like now) it is unnerving for investors. Heather Brilliant, President and CEO of Diamond Hill Capital Management reminded the room, “the most meaningful investment risk is not volatility – it is a permanent loss of capital.” She discussed companies which are leaders in their industries which “are not going anywhere for a long time.” Brilliant spoke about how volatility brings investors the opportunity to acquire market leading businesses at cheap prices. “Not all volatility is related to fundamentals,” she suggested. The markets can move for all sorts of reasons – fear, greed, liquidity…the key is to focus on businesses which have the ability to last. Markets are likely to experience continued volatility going forward and investors need to use the volatility to their advantage rather than induce them into making a mistake. “Resiliency” was a key word used in the discussion.

The Portfolio for the Future is Rooted in a Fiduciary Mindset

Fiduciary is a term which implies having trust and acting in the best interest of the client. One of the key aspects of a “fiduciary mindset” is aligning purpose to client needs and not just targeting a static asset allocation. The Joseph Group is a firm which seeks to use planning and portfolio management as tools to help our clients live out their purpose and we could not agree more.

There is No Single Portfolio for the Future

The term “60/40 portfolio” is used a lot in financial circles because for decades, having a balanced allocation of 60% stocks and 40% bonds has generally been successful at generating strong returns while mitigating volatility. It’s tempting to say, “ok, if the 60/40 was the thing which worked in the past, what’s going to be the one thing which will work in the future?” The conclusion from the panel was “there is no single portfolio for the future.” Some investors may want to protect capital, some may want to provide cash flow, some may want growth, and some may have aspirational goals they want to achieve through their portfolios. There is no “magic portfolio” – the key is identifying the objective and put together a portfolio which provides the investor with market resiliency and the greatest opportunity for success in meeting that objective. We believe that our process of starting with the end in mind – the objective – allows us to avoid rigid thinking on what works and gives our clients the greatest chance for success in living out their story, whatever that may look like.

Written by Travis Upton, Partner, CEO and Chief Investment Officer