Notes from the Road – “Keep what’s most important, most important”

October 28, 2022

To Inform:

This week I had the chance to join a few of my peers here in Columbus for dinner with the Chief Economist and the Head of Technical Strategy at Strategas, a research firm whose partnership we greatly value. Both individuals spent 15-20 minutes on what they’re paying attention to in their work. The Technician reminded all of us of one very important maxim: “keep what’s most important, most important.” The Chief Economist gave a few “high conviction calls” that, combined with what the market is telling us, should at least give us a roadmap for what the path ahead looks like. So, let’s dive in.

A market technician’s job is to ascertain the wisdom of the crowd. In other words, their job is to look to price action in the market and ask what that might be telling us. At dinner, the Strategas technician shared with us his belief that one of the most important things in today’s market is to “be different than the index”. This week, 4 of the 10 largest companies in the S&P 500 reported earnings. The market reaction to these earnings reports ranged from mild disappointment to deep selloffs. Looking different than the index means owning less of those types of companies and more of the companies not found at the top of index. In terms of what this looks like in practice, consider the chart below. This tracks the relative return of the Nasdaq 100 against the Equal-Weight S&P 500 (the average stock in the S&P 500 Index) since 2016. Aside from a few hiccups here and there, the line essentially goes one way until late 2020. Since then, the average stock has begun to outperform the Nasdaq 100.

Source: Strategas

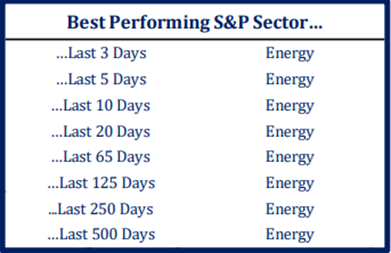

One easy way of looking different than the index is by owning more of what the index doesn’t own. An investor who purchases an S&P 500 Index Fund is likely to own somewhere around 4-5% in energy stocks. Despite such a low weight in the index, the energy sector accounts for over 10% of aggregate earnings of the S&P 500. One of the big takeaways from dinner with Strategas was that “leaders lead.” If there’s any doubt about where leadership is, look at the table below.

Source: Strategas

While it’s fun looking at charts, it’s also important to have a good handle on the fundamental economic backdrop. In the spirit of keeping the most important thing the most important thing, the Chief Economist at Strategas shared a few high conviction calls. One such call is that the Fed will not relent in their battle against inflation despite calls from market participants, politicians, and even the United Nations to do so. What this means for markets in the near term is a period of slower growth, as demand adjusts downward to meet supply. The jury is still out as to whether or not this period of adjustment simply means a slowdown or leads to recession.

The other big call is that inflation doesn’t get back to the Fed’s stated target of 2%. The thinking here is that a couple of powerful disinflationary forces that have been with us for decades are reversing. Reshoring in manufacturing from places like China, shrinking domestic labor forces in the US and Europe, and the rapid disappearance of cheap energy from Russia and U.S. shale plays mean the Fed may end up having to settle for “mission accomplished” at 3% instead of 2%.

This year has been a year that can be described in a lot of ways. One such way may be “regime shift.” What’s most important today can be summed up in a few ways. The market darlings of the 2010s have underperformed the rest of the market since 2020. Energy stocks, once the bane of most investors’ existences, have been market stalwarts. Inflation, long an afterthought in the 2010s, may be falling from its peak but looks stickier for longer. All these changes seem longer lasting, and they require a different playbook than the one that worked last decade. We pride ourselves here at The Joseph Group in the way we think differently about portfolio construction and are thankful for the trust our clients place in us to navigate these challenging times.

Written by Alex Durbin, Portfolio Manager