Opposite Extremes

May 6, 2022

To Inform:

In recent days, I feel like I’ve observed multiple examples of “opposite extremes.” Late afternoon on Wednesday I had a headline flash on the CNBC app I use to track stocks and asset classes on my phone: “Stocks have best day since 2020!” Just 24 hours later, on Thursday afternoon, I had a similar looking alert say “Stocks have worst day since 2020!”

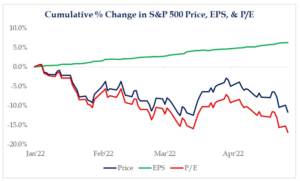

I’ve observed a similar pattern of opposite extremes in client conversations. When market volatility goes up, so do emotions. With the S&P 500 down about -12% since the start of the year, one client I met with earlier this week was actually excited. “This is the best buying opportunity we’ve had in a long time!” As part of the conversation, we went over a chart (below) we shared at last week’s Portfolios and Pints event. The green line reflects corporate earnings per share since January. The green line is rising, meaning corporate earnings in aggregate are higher than they were at the start of 2022. On the other hand, the red line reflects the price to earnings (P/E) ratio which has declined about -15%. Putting the two together, earnings are higher than they were at the start of the year but the price being paid for those earnings is lower. This client went on to say, “that’s exactly it – you are getting more for your money – stocks are on sale!”

Source: Strategas Research Partners

On the other hand, another client was much more concerned about the market volatility and cited the sharp rise in interest rates since the beginning of the year. “With the 0.25% hike in March, and another 0.50% hike in rates this week, the Fed is just getting started raising short term interest rates. Bonds (bond prices move in the opposite direction of interest rates) are getting clobbered – if rates keep skyrocketing are things going to get worse?”

For perspective, the chart below shows the interest rate on the benchmark 10-year Treasury note over the last decade (going back to 2012). Rates have had a sharp upward move and the current rate of about 3% is the highest since 2018, the last time the Fed started to increase rates.

Our own take is that we believe volatility in the bond market will slow down in the weeks and months ahead and that’s not a prediction, that’s just math. The higher rates go, the more of an interest cushion bonds have against further rate increases. With the 10-year Treasury rate close to the highest levels in a decade, the interest cushion is also close to the highest levels in a decade.

Finally, I want to discuss an “opposite extreme” we observe within the stock market, which has been a huge item of discussion for our Investment Strategy Team and how we are thinking about the objective-based portfolios we have the privilege of managing for clients. Dividend paying stocks are holding up much better than growth stocks in the midst of the current market volatility.

Below is a chart showing a dividend paying stock mutual fund we are familiar with (green line) versus a popular aggressive growth exchange traded fund (red line). The growth fund is down about to -50% year to date while the dividend paying stock fund is down about -1%. The opposite extremes illustrated here have important portfolio management implications. We don’t need to abandon stocks to get more stability in portfolios, we need to look at different areas of the stock market.

Source: Yahoo Finance

When there are “opposite extremes” happening in the markets, our job is to prioritize logic over emotions. In the days and weeks ahead, clients of The Joseph Group will likely see more trade confirmations reflecting activity in their accounts. In addition to rebalancing and seeking investment opportunities across objective based portfolios, volatility brings opportunities for tax management. We will be making “tax swaps” between securities to realize losses but maintain exposure to areas we like for the long-term. By making “swaps” we can capitalize on the losses created by volatility to potentially offset other gains or income while maintaining the potential for recovery when the market bounces.

Written by Travis Upton, Partner, CEO and Chief Investment Officer