Paging Doctor Powell – March Fed Meeting Recap

March 22, 2024

To Inform:

The market has exhibited signs of a mild inflationary “fever” over the last couple of months, as recent inflation reports have been warmer than expected and the hope of cuts to the Fed Funds Rate has begun to shrink. This put the March meeting of the Federal Reserve’s Board of Governors held this past Wednesday in the spotlight. So, what was the good doctor’s diagnosis and how did the “patient” handle it? Dr. Powell (he’s not actually a doctor but stick with me for the metaphor) advised the patient to “take 3 rate cuts and call me in the morning.” Judging by the market’s reaction, I’d say it was just what the patient was looking for.

To understand why the patient was feeling a bit feverish let’s look at recent inflation data. The March CPI report released earlier this month showed inflation stubbornly hanging out at levels above the Fed’s long-run target rate of 2.0%. Other inflation data points have been similarly warm, and evidence is there that getting to the target rate is going to be a process. On that front, Dr. Powell seems unbothered, with one of Bloomberg’s financial journalists noting “the committee didn’t take many signals from recent hot CPI reports.”

Source: Hamilton Lane

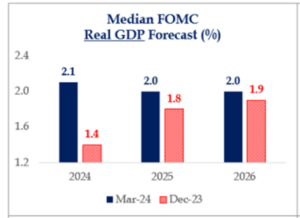

Why isn’t the Federal Reserve worried? For one, the Fed is forecasting stronger growth in 2024, with their forecast for Real (meaning adjusted for inflation) GDP growth in 2024 predicted to be 2.1% compared to their December 2023 forecast of 1.4%. They also observe an increase in labor force growth should help keep a lid on inflation this year.

Source: Strategas

The doctor is usually right, and all signs seem to point toward the Fed guiding the economy to the much hoped for soft landing. I remain a little concerned about what appears to be the Fed saying, “Maybe we can live with 2.5% inflation.” I think the Fed’s guidance for three rate cuts leaves the door open for continued strong economic growth which we see in the chart above, but it also leaves the door open for inflation to be higher for longer.

Finally, getting down to brass tacks – what does the market think about all of this? It is loving the idea that economic growth can continue to run with Wednesday seeing small cap stocks, financials, and consumer discretionary stocks all doing well. High yield bond spreads closed at year-to-date lows (great for credit conditions). The one area of the market that suggests maybe the inflationary fever doesn’t break quite like the market expects? Gold, which hit a fresh all-time high yesterday and appears to have decisively broken out of a range it has traded in since 2020.

Source: BullionVault

There is lots to like about the doctor’s reaction to recent inflation data and the soothing prescription for a healthy degree of rate cuts. We’re thrilled that across many of the client portfolios we have the privilege of managing there is exposure to things like small cap stocks, financials, and gold which we believe will be beneficiaries of the doctor’s medicine. That said, we’ll be keeping an eye out throughout the year to see if the market needs to be ready for a “second opinion”.

Written by Alex Durbin, CFA, Chief Investment Officer