Pilot Your Financial Plan(e)

May 13, 2022

To Inform:

From someone who loves to travel, it seems only natural to liken financial planning to the airline industry. Financial planning is like being an airline pilot. You need a flight plan, must know where you’re going, check all of your gauges and make corrections when you run into turbulence.

Here at the Joseph Group, we are the co-pilot, but you, the client, are pilot. As you fly towards your great life (i.e. the destination) we can help you navigate. Clearly this has been a very turbulent time in markets, so we want to share some thoughts on how volatility might impact your portfolio, and specifically consider a slight course correction for folks taking portfolio distributions.

During the “growth phase” of your life, volatility is your friend. When adding to a portfolio, we are able to take advantage of down markets by buying in at lower prices. Volatility in this phase of life actually creates value. If you are in this stage, now would be a good time to consider whether you have excess cash to invest or have the ability to accelerate contributions to your retirement accounts or fund your 529 plans earlier in the year than you were originally planning.

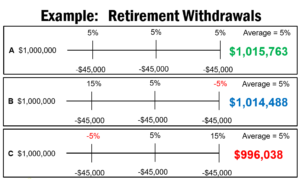

In contrast, during the “distribution” phase of your life, volatility works against you. Every distribution locks in a loss. Consider the example below:

Here you can see 3 different client situations taking withdrawals early in retirement. All of the clients start with $1,000,000, withdraw $45,000 annually, and have the same average 5% return. Client A achieves his 5% return with a steady 5% return each year and his portfolio value increases. Client B has a large 15% return in the first year, but in the last year takes a small 5% hit. His average is still 5%, but we get a slightly different ending balance. Thus, volatility cost him even though he started with a solid 15% return the first year. Lastly, Client C starts his retirement with a small 5% negative year, but ends with a large 15% return. Again, Client C still has an average return of 5%, but the volatility reduced the overall portfolio value considerably because the initial $45,000 distribution during a 5% down year locked in a loss and which was then compounded over the remaining time periods.

So, with this all being said, is now a time to consider stopping or reducing your regular monthly distributions? Are your checking and savings balances building up such that you don’t need the distributions? We will say: materiality counts! In other words, a $100/month distribution has much less impact on a $1Million portfolio than a $5,000/month distribution on the same portfolio.

Along these lines, are there other larger distributions you were considering that you might be able to hold off until later in the year to allow your portfolio to recoup its losses? For instance, this could be annual gifting to kids or grandkids, charitable gifting, a major purchase, or even your retirement account’s required minimum distribution.

Making decisions like this can be difficult. That’s why we always bring our clients back to their plan. Spending and investing decisions should always be in the context of the bigger picture plan. This is where we can help as your co-pilot. Together, we’ll navigate a soft landing!

Written by Theresa LeChard, Wealth Advisory Associate