Policy Uncertainty is A Good Thing for the Markets???

November 17, 2023

To Inform:

“What impact will the Presidential election have on the market?”

Last night I (Travis) had the opportunity to join a group of astute investors for their regular investment partnership meeting. We enjoyed terrific company, delicious food, and engaged in lively conversation. When the discussion shifted to markets, the fact the Presidential election is less than a year away was a big topic of conversation. The future is always in motion, but let’s take a look at three points on what history would suggest may lie ahead for markets as we approach next year’s election.

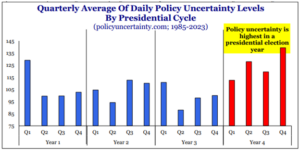

At the risk of stating the obvious, policy uncertainty rises in a presidential election year. Not only are people concerned about who the President may be, they are concerned about tax policy, interactions with Congress, geopolitics, spending, and countless other issues. We believe the media also plays a role in the “ramping up” of concerns as controversy = ratings.

Source: Strategas Research Partners

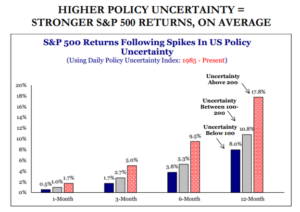

Historically, higher policy uncertainty has meant stronger returns for the S&P 500. Ok, we think this one is much less obvious. Higher uncertainty has corresponded with higher market returns?? It may not seem logical, but that’s what the data shows. Based on “policy uncertainty data” from policyuncertainty.com, the higher the amount of uncertainty the better the returns from the S&P 500. Why? We believe it may have to do with our maxim of “investors tend to respond more to better/worse than good/bad.” The higher the policy uncertainty, the more “bad” things may seem, but the “better” things have the potential to be in the future as uncertainty declines.

Source: Strategas Research Partners

If an incumbent is running, the S&P has been positive during the election year. Here is another interesting factoid – since 1952, when a president is running for re-election, regardless of how voters feel about that president, the market has been positive every time. It’s only been open election years, where there is no incumbent, when the market has hit a speed bump. We note the data includes 2020 – an especially extreme year when the Presidency changed parties and the economy was still dealing with COVID. The path was a roller coaster but the S&P 500 finished 2020 over +18% higher than where it started on January 1.

Source: Strategas Research Partners

There is an old, but popular Wall Street adage that “markets tend to climb a wall of worry.” Of course it’s important to remember that each year is its own year and that historical trends may not follow through each cycle. But based on historical data, a presidential election year produces a lot of worry, but stocks have tended to put on their climbing boots. If history rhymes, the playbook suggests playing offense in 2024 and waiting until 2025 to put the defense on the field.

Written by Travis Upton, Partner, CEO and Chief Investment Officer