Politics, Performance, and Presidents

June 30, 2016

First we talked about Brexit – the British referendum vote to leave the European Union. Those in attendance seemed relieved the global stock market has put together a three of strong days and has recovered the majority of the losses from last Friday’s market decline. Putting the market aside, we had a great discussion about facts behind the referendum, the demographics of who voted “leave,” and what the next concern is on the horizon. We believe it could have huge global economic and monetary ramifications if other countries also decided to leave the EU. A Spanish “Spexit”, a French “Frexit”, or an Italian “Italeave” (my personal favorite) would all involve countries who use the Euro as their common currency.

We also talked about performance of different areas of the stock and bond markets so far in 2016. The first half of the year is almost over and although the final first half numbers will be computed today, here is a summary of what we are seeing:

- “Growth” style stocks have struggled the first half of the year with three key sectors – financials, technology, and health care all posting negative returns (based on Morningstar data).

- “Value” style stocks, have led the market with leadership coming from utilities, telecom, and energy stocks.

- Outside of the United States, developed markets in Europe and Japan have struggled (year to date returns have been determined by activity in the last week) but emerging markets (think India and Brazil) are among the best performing markets in the world.

- Both high quality and junk bonds (credit) have been strong performers in 2016 due to declining interest rates and contracting credit spreads – both of these factors serve to increase bond prices.

- Real Assets – commodities and real estate investment trusts have outperformed U.S. stocks the first half of the year

Finally, we talked about politics and markets. Without promoting either candidate, here are some interesting observations we are seeing related to Hillary, Donald, and the markets:

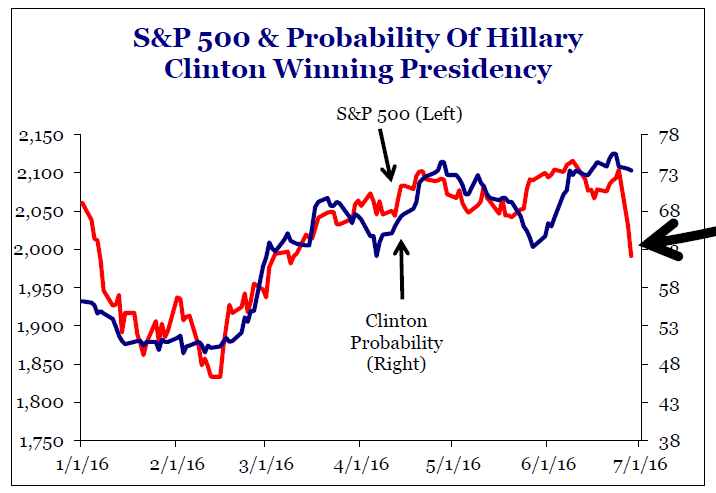

1. Evidence seems to suggest the stock market would prefer Hillary Clinton president. Polling data showing the probability of Hillary winning the presidency has a 90% correlation with the S&P 500.

Source: Strategas Research Partners

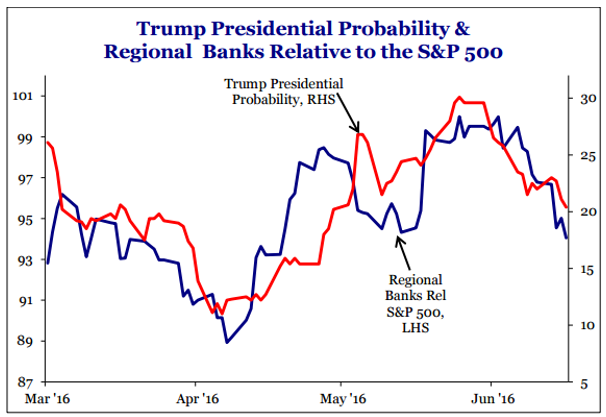

2. Donald Trump seems like the better candidate for banks. Regional banks have shown a high correlation with the probability of Trump winning the presidency – rising and falling in virtual lockstep with Trump’s polling data.

Source: Strategas Research Partners

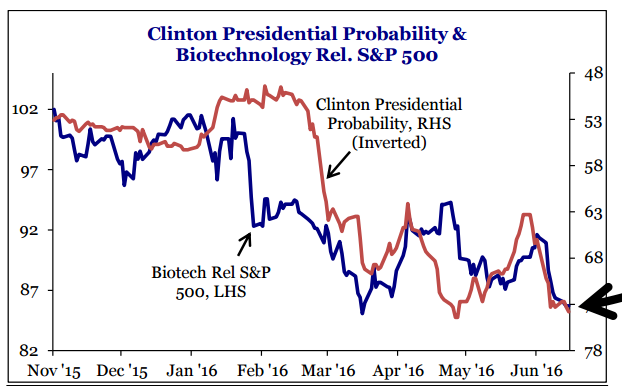

3. Hillary Clinton does not look like the favored candidate for biotechnology companies. Perhaps it is concern about further drug regulation, but Hillary’s probability of winning the presidency (inverted on the chart) seems related to negative performance for biotechnology companies.

Source: Strategas Research Partners

“Portfolios at Panera” is held the last Thursday of every month at various Panera sites around the Columbus area. We hope to see you at one of these events in the months ahead!