Potential Market Catalysts for the 4th Quarter

October 4, 2024

To Inform:

As we enter the final quarter of 2024 there are several events on the horizon that could be major catalysts for markets. In a recent discussion with The Joseph Group’s Investment Committee, we discussed some of these catalysts and what the potential impacts these could have on markets. In this WealthNotes, we’ll look at three major catalysts and consider them through an assets and liabilities perspective.

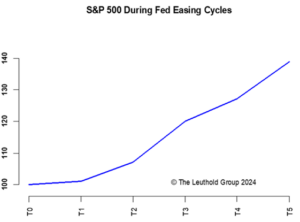

The first catalyst is that we are now entering an interest rate easing cycle. The cycle started off with a bang, with the FOMC lowering the Fed Funds rate by 0.5% in September. On the asset side of the ledger, the performance of the S&P 500 during Fed easing cycles, on average, has been positive. The chart below from The Leuthold Group shows the S&P 500’s performance with easing cycles (which vary in length) divided into five periods. The S&P 500 has been slow to react in the first 20% of an easing cycle, but as time goes on returns have tended to pick up speed. A potential “liability” to this catalyst? At the start easing cycles going back to 1980, the S&P 500 traded at an average P/E of 15.1. Since 1995, the S&P 500’s P/E has averaged 21 at the start of an easing cycle. Today, the S&P 500’s trailing P/E ratio is 27.

Source: The Leuthold Group

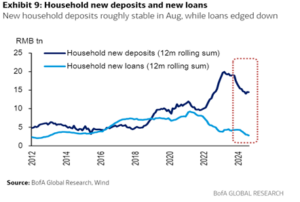

Another catalyst is the early evidence that China is taking steps to stimulate their economy. China’s economic data has been a major disappointment since the pandemic began to ease. Some of this is related to the unique challenges that China faces (demographics, housing as an investment philosophy, etc.). These challenges feed into a negative sentiment feedback loop, with investors around the world and even within China relatively uninterested in Chinese stocks. As you can see in the chart below, there has been a significant buildup of cash at the household level in China. A shift in sentiment through easing monetary policy and especially tax credits could work to take some of the significant amount of cash in Chinese household balance sheets off the sidelines. The knock-on effects of this reversing would likely be seen in sectors and countries with large exports to China. The potential liability to this catalyst is the lack of follow through or misdirected stimulus to local governments in China that would do little to stimulate the “animal spirits” needed to fuel a sustained rally in stocks.

Source: Bank of America

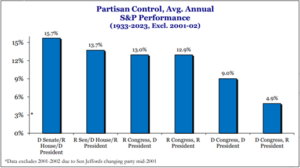

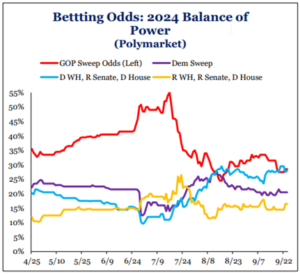

The final catalyst is elections here in the U.S. next month. With polls pointing to a very close election, the likelihood that the result is some form of divided government is high. The first chart below from Strategas shows the average annual performance of the S&P 500 under a variety of regimes. The three best regimes have all been under some form of divided government. Complete Republican control has been close, but still lags. The liability here is either a contested election akin to 2000 or 2020, or the potential for a Democrat sweep. Viewed purely through the lens of performance, complete Democrat control has historically coincided with much lower returns than other outcomes (but much better than a Democrat Congress and Republican White House). Predication markets today give only a 20% chance to a Democrat sweep and aren’t even pricing a Democrat Congress and Republican White House.

Source: Strategas

Source: Strategas

We’re as excited as you are for this quarter to unfold. As it does, we think these three catalysts are some of the most important ones with respect to their potential to impact markets.

Written by Alex Durbin, CFA, Chief Investment Officer