Predictions – Hold on Loosely

June 13, 2025

To Inform:

There is a tension in the investment world. Predictions can be valuable and are important exercises. Here, having an imagination can be a valuable tool. Anticipating where markets are heading requires one to think about a range of possible outcomes. Sometimes those outcomes seem murky, sometimes they seem crystal clear. But even when outcomes seem crystal clear, predictions end up being wrong. That said, I think predictions are worth making but, like so many other things in life, we must hold on to them loosely.

I was skimming old emails this week to tame my inbox. One email I came across was from a Bloomberg columnist written about a year ago. In this email, the columnist discussed the potential for tariffs should then former President Trump be reelected in November. The columnist warned of upward pressure on inflation, the dollar, and bond yields should tariffs be implemented. Directionally, the columnist was right. Tariffs indeed were implemented, but none of the specific outcomes the columnist warned of have transpired (yet).

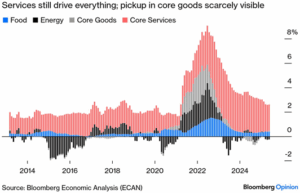

Let’s start with inflation. No matter where one stands on the income ladder or stage of life, the sting of a higher cost of living after several years of above-average inflation has been felt. Everyone, the Investment Strategy Team at TJG included, is on the lookout for a resurgence of inflation. A columnist conditioned by several years of inflation can easily be forgiven for worrying that tariffs might further stoke it.

We simply aren’t seeing that play out. On Wednesday we received news that the rate of inflation in the month of May was up 0.1% over the prior month. Economists had been predicting an increase of 0.3%. More interestingly, not a single economist out of the 73 surveyed by Bloomberg predicted an increase of just 0.1%.

Source: Bloomberg

The impact of the continued trend in lower inflation is being felt in the bond market. The interest rate on the US 10-year Treasury Bond last summer bounced around between 4.2% and 4.5%. Since tariffs became page one news in March and reality in April bond yields have bounced around between, you guessed it, 4.2% and 4.5% (aside from April 3rd, when they briefly plumbed 4%).

Discussions around the impact on the dollar before tariffs were implemented predicted that tariffs would lead to an increase in the dollar. Reality has been different. The dollar has weakened by over 8% since the beginning of March.

So, why haven’t predictions come to pass? Why hasn’t inflation surged, bond yields gone up, and the dollar strengthen? I’ll start by saying that some economists don’t agree that tariffs are particularly inflationary. The economics team at First Trust claims the link between tariffs and a broad increase in inflation is overrated. Their view is that tariffs “shuffle the deckchairs on the inflation ship, not how high or low the ship sits in the water.” They agree with Milton Friedman that inflation is “always and everywhere a monetary phenomenon”, meaning that when the government increases the supply of money, inflation goes up.

The lack of any sustained inflationary response so far to tariffs has probably helped keep bond yields under control. Some market prognosticators earlier in the year were predicting the Fed may need to hike rates in 2025. Finally, the moving target of tariffs and the fact that the dollar is a global reserve currency means some of the predicted currency behaviors of an importing country like the US won’t come to pass.

The investment world is full of surprises which is one reason why I love applying the lyrics from .38 Special’s “Hold on Loosely” to predictions in markets. It is ok and worth making them but hold on loosely. Don’t cling too tight. As the facts and circumstances change, be willing to revise your predictions.

Written by Alex Durbin, CFA, Chief Investment Officer