Previewing “TJG’s Picks for 2026”

December 19, 2025

To Inform:

It’s an annual tradition at The Joseph Group to identify major themes we think will have the biggest impact on portfolio decisions in the upcoming year. It’s important to note in this process we are identifying themes and NOT making predictions. To quote Leuthold Group founder Steve Leuthold, “predictions are for show, but portfolio changes are for dough.” In other words, we want to identify key areas of focus which may cause us to make proactive or reactive portfolios changes throughout the year.

We always try to have a catchy title, and preferably one that rhymes. So as TJG Chief Investment Officer Alex Durbin and the Investment Strategy Team work on the themes for the upcoming year, here is a preview of three of “TJG’s Picks for 2026.”

International Stocks: Was 2025 a Headfake or the Start of a New Trend?

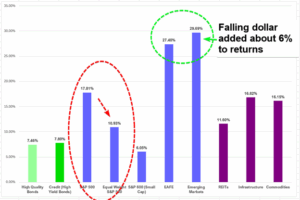

In last week’s WealthNotes, Alex recapped our recent Portfolios and Pints event and included the chart below which shows the YTD (through November 30) performance of indexes representing major asset classes. The key here is the two biggest bars on the chart are the indexes representing international stocks.

Source: TJG Global Investment Research

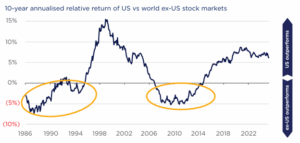

I’m not sure many investors would have predicted international stocks to be the best performing of the major asset classes in 2025, but that’s exactly what has happened. Now the key question is, does international stock performance leadership continue? The gold circles in the chart below show extended periods where foreign stocks did outperform U.S. stocks – it happened in the late 1980s and again in the early 2000’s. As we look at the data, cheaper valuations, accelerating foreign earnings growth, and a weaker dollar could all be factors which mean foreign stock leadership could continue in 2026.

Source: Orbis Investments

Is a Mid-Term Election Year a “Wet Blanket” for the Market?

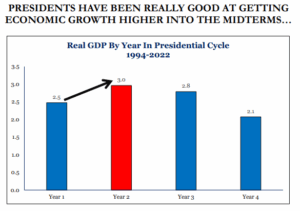

We always try to call it down the middle and focus on “policies” and not “politics.” Here is another example of looking at the facts and learning from history. Next year is a mid-term election year. Mid-terms are typically a time when the economy accelerates (as shown in the chart below) as Presidents try to promote policies which “juice” growth.

Source: Strategas Research Partners

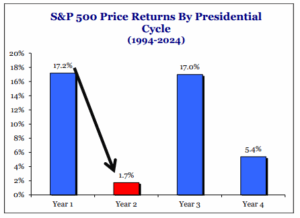

Now, that may sound like a good thing for stocks, but that’s not necessarily what the data shows. In recent years, the second year of the Presidential Cycle (the mid-term election year) has generally been the weakest of the cycle. Why? We would say there are two key reasons. First, the market is generally good at pricing in higher growth before it happens, and second, the higher growth can result in higher interest rates, which seems to coincide with market volatility.

History doesn’t repeat itself, but it often rhymes. With 2026 being a mid-term election year, we will be on the lookout for higher interest rates and potentially more volatility in stock prices.

Source: Strategas Research Partners

Will “The Rest of the Market” Catch Up?

Finally, much ink has been spilled in the financial media about the performance leadership of the “Magnificent 7” technology stocks. Referring again to the first performance bar chart, the first red circle shows the performance of the market cap (size) weighted S&P 500, up +17.8% through 11/30 compared to the equally weighted S&P 500, up +10.9%. The almost 7% performance gap reflects the disproportional leadership of the big technology companies, again through 11/30.

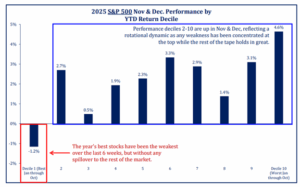

However, as we get into December, we are seeing an interesting phenomenon. Through 12/18, the performance gap between the market cap and equally weighted S&P 500 has narrowed to about 5%. As shown in the chart below, in recent weeks the year’s best performing stocks have declined while “the rest of the stock market” has had positive performance.

Source: Strategas Research Partners

If the “rest of the market” beyond technology stocks is indeed poised to catch up, it could have positive implications for dividend paying, value, and small company stocks.

As we approach 2026, there are bound to be surprises. However, if we can identify scenarios in advance, and have a game plan if those scenarios play out, we will be in a better position to navigate markets and achieve the objectives of our clients.

Written by Travis Upton, Partner and CEO