Principles for Successful Long-Term Investing Part 1: Volatility Can Be Your Friend

May 31, 2024

To Inform:

Recently, JPMorgan put out a presentation called “Principles for Successful Long-Term Investing.” The piece highlights seven concepts which, when followed, can “tip the odds in favor” of long-term investors. Over the course of the summer, we plan to use the “To Inform” portion of WealthNotes to highlight these seven concepts, and how The Joseph Group applies them to seek better outcomes for clients. In the weeks ahead, we will intersperse these “Principles for Successful Long-Term Investing” concepts with timely current event topics.

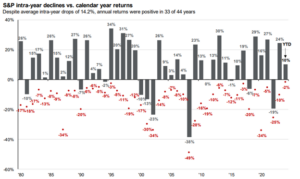

Volatility in financial markets is normal. When describing the chart below, JPMorgan reminds investors that every year has its rough patches. The chart below looks at each calendar year for the S&P 500 going back to 1980. The gray bars reflect the annual return for the S&P 500 each year while the red dots reflect the intra-year decline, or pullback, the S&P 500 experienced at some point during each of those years. Here are a few key statistics:

- The average intra-year decline (average of the red dots) was -14.2%

- Double digit (in excess of 10%) declines happened in 25 out of 44 years

- Annual returns for the S&P 500 were positive in 33 out of the 44 years

- During the period shown, the average annual return for the S&P 500 was +10.3%

Source: JPMorgan Asset Management, FactSet

Diversification works: you don’t have to get all of the ups if you don’t get all of the downs. TJG’s Investment Strategy Team often talks about “capture ratio,” which is a fancy term for how much upside a strategy gets relative to its downside. If we can provide some protection on the downside, we don’t necessarily need to get all the market’s upside to achieve attractive long-term compounded returns.

Pop Quiz: Which of the following two portfolios would you rather have?

- Portfolio A: Down -50% in Year 1, Up +100% in Year 2

- Portfolio B: Down -40% in Year 1, Up +70% in Year 2

If you answered Portfolio B, you are right! If you put $100 in Portfolio A, you would be at breakeven at $100 after two years (down to $50 in Year 1, back to $100 after Year 2), while if you put $100 in Portfolio B, you would have $102 (down to $60 in Year 1, up to $102 after Year 2).

The example here is extreme, but it illustrates the concept that investment math is not linear. Even though an investor in a diversified portfolio may not get all the upside when the S&P 500 is the best performing part of the market, buffering declines can lead to successful long-term compounded returns, and in turn, a higher level of wealth.

Volatility can be your friend: automatic monthly contributions. Investors who are in “accumulation mode” can make volatility work in their favor by making automatic monthly contributions to their accounts.

Last year, I had the opportunity to work with a new client whose investing habit was to make a large contribution to his retirement plan at the end of each year. He would look at his year-end cash flow and take a portion to max out his retirement plan contribution – it was easy for him. I explained with some behavioral changes, we could increase the odds of his long-term investing success. After all, markets have a seasonal tendency to be strong at the end the year, so his annual contributions were usually going in at a market high point.

We worked with his team to shift his retirement plan contributions to a monthly basis. He was still making the same annual contribution, but by dividing the amounts and putting funds in monthly, when the market had its intra-year volatility, he was buying more shares at lower prices. In other words, he changed his behavior to be more in line with buying low and selling high! Using the chart above as a visual, rather than making one big contribution at the end of the gray bar each year, he made smaller contributions throughout the year, buying as the market bounced between the end of the gray bar and the red dot each year. The simple shift allowed volatility to work in his favor as he was automatically buying shares at lower prices when the market had its inevitable dips, not just looking at his account and grimacing.

Note – if you are part of a company 401(k) retirement plan which is making contributions through payroll deductions, you are already doing this!

Volatility is normal and inevitable. We cannot eliminate it, but we can use diversification to mitigate volatility and automatic monthly contributions to make volatility work for us rather than against us.

Written by Travis Upton, Partner and Chief Executive Officer