Principles for Successful Long-Term Investing Part 2: Plan on Living a Long Time

June 14, 2024

To Inform:

This week we continue our series on “Principles for Successful Long-Term Investing.” These are concepts which can “tip the odds in favor” of long-term investors, based on a presentation from JP Morgan. Today’s focus – planning to live a long time.

Earlier this week, Theresa LeChard, our Senior Wealth Advisory Associate, and I were meeting with a prospective new client. As Theresa was explaining our planning process she shared, “we typically run the projection out to age 95, unless you have history of longevity in your family, in which case will run it out past age 100.” The prospective new client laughed and replied, “there is no way I want to live to age 95 – we don’t need to run out the plan for that long!”

Mortality is an uncomfortable topic we unfortunately must discuss in our work, and the prospective new client’s response was not uncommon. Based on family history, past experiences, etc., running a financial plan out to age 95 is something many clients scoff at. However, data would suggest life expectancies in the U.S. continue to increase and more and more people are living to older ages.

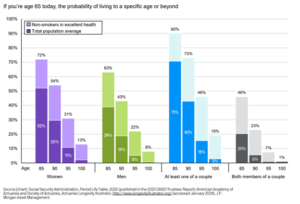

The chart below comes from data from the Social Security Administration and was published in the 2023 “Old-Age, Survivors, and Disability Insurance (OASDI) 2023 Trustees report. The chart looks at probabilities for someone who is age 65 today living to a specific age or longer. For example, a 65-year-old non-smoker in excellent health has a 72% chance of living to age 85 and beyond and a 54% chance of living past age 90!

We often have the privilege of putting together plans for couples. For a 65-year-old couple, the odds of at least one person in the couple living to age 95 or longer is 46%…within the margin of error of a coin toss.

Source: JPMorgan Asset Management

Even though our prospective new client didn’t want to run her financial plan to age 95, the data would suggest doing it anyways is essential for assuring the plan is on solid footing. And if planning for longevity is so essential, what are the implications? Here are a few we discuss often:

- Saving and investing more needs to be part of the process. One of the most important ways we can help clients is behavioral – and that means setting good habits today to save and invest more for the future.

- Getting “more conservative” with age may not make sense. We’ve seen rules of thumb saying a suggested percentage allocation to stocks is “100 minus your age,” implying the allocation to stocks gets smaller the older a person gets. Longevity suggests such a rule of thumb may not make sense. The longer people live, the more they may need a growth orientation for their investments to make sure their money outlives them. We’ve seen studies which suggest the optimal strategy for making a portfolio last may actually be increasing the level of aggressiveness/growth orientation after retirement.

- Higher interest rates make the math of planning for longevity easier. We’ve seen this with pension systems – the present value of future pension liabilities is discounted at an appropriate interest rate. The higher the interest rate, the smaller the present value of future liabilities, and therefore the better the funding status of the pension, all else equal. For plans we run for individual clients, we keep things much simpler than pension math, but the impact is similar – higher interest rates imply higher rates of return, which makes planning for longevity much easier.

The Joseph Group has the privilege of being a guide for our clients – using planning and portfolios as tools to clarify the path and help our clients live out their purpose. Living for a long time means a greater opportunity to impact the people we love and is something to celebrate!

Written by Travis Upton, Partner and Chief Executive Officer