Proud Father Moment and the Rule of 72

August 2, 2024

To Inform:

My oldest son, Spencer, is currently in grad school pursuing his dream of becoming a physical therapist. Several years ago, when Spencer was in high school, he had the opportunity to take a personal finance class, something I strongly encouraged him to do. One day after school, he said to me, “Dad, we had a quiz today about mortgages and at the bottom of the test I wrote: “those who understand compound interest earn it and those who don’t pay it.”” Wow!

Spencer didn’t come up with the quote, but him saying it has been one of my proudest Dad moments. The original quote is attributable to Albert Einstein who said, “Compound interest is the eighth wonder of the world. He who understands it, earns it….he who doesn’t…pays it.”

Source: A to Z Quotes

I had the opportunity to share wisdom from Spencer Upton and Albert Einstein this week as I talked to a group of 20-something interns and residents at Cypress Church about managing finances. We talked about psychology around money (purpose), how knowing and controlling spending can make or break a financial plan (planning), and the concept of compound interest (portfolios).

Compound interest is a complex sounding term, but it simply means money can grow exponentially over time, as interest earns interest on top of interest. In other words, compound interest accumulates not only on the initial amount invested, but also to the interest in previous periods.

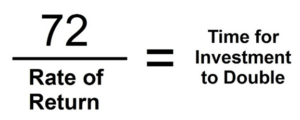

To share this concept with the students, I shared the Rule of 72. The Rule of 72 provides an approximation of how long it will take for an investment to double at a particular interest rate. The formula is below:

Let’s look at a couple of examples. Let’s say an investor invests $1,000 and can earn a 6% interest rate. Using the Rule of 72, it will take approximately (72 / 6 = ) 12 years to double. (Note: I checked in Excel…the $1,000 grows to $2,012.20 in 12 years assuming annual compounding, but close enough).

On the other hand, if the investor invests the same $1,000, but earns a 8% interest rate, it will take approximately (72 / 8 = ) 9 years for the investment to double.

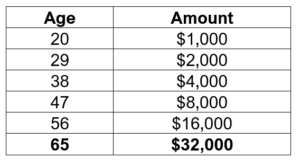

I then drew on the whiteboard how this can play out over time. If we assume the students (currently age 20) invest $1,000 and that money grows at 8%, and therefore doubles approximately every 9 years, the table looks like this:

Simply using the math of compound interest, and the Rule of 72 as an approximation, we can see a $1,000 investment, growing at 8% can grow to $32,000 by age 65. And that’s with no additional contributions – just interest on top of interest!

So, we covered the “those who understand, earn” part, but what about the “those who don’t pay it” part?

I asked the group if they had a credit card. We then looked up average credit card interest rates, which according to Federal Reserve data from the first quarter of 2024 is a whopping 22.63%!

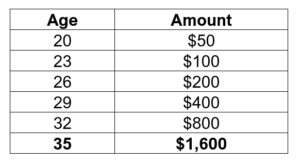

If we apply the Rule of 72, a 22.63% interest rate would imply money at that rate would double every (72 / 22.63 = ) 3.18 years. With credit cards though – we aren’t talking about earning interest, we are talking about paying it!

We then considered an example where someone bought a $50 pair of jeans on a credit card but didn’t pay off the card. If we round the period of doubling to every 3 years, here is what it looks like:

In this example, by age 35, the student has accumulated $1,600 in credit card debt…all from buying a $50 pair of jeans in their 20’s and not paying off the card!

Understanding compound interest is foundational to investing and financial planning. For those who earn it, time is a powerful ally. For those who pay it, time can dig an insurmountable hole.

Educating younger people about personal finance can make a monumental impact on how they approach money, and, in turn, the rest of their lives. Understanding compound interest and applying the Rule of 72 as a simple tool can be a great place to start.

Written by Travis Upton, Partner and Chief Executive Officer