Questions in Today’s Market

September 13, 2024

To Inform:

The Joseph Group CEO Travis Upton and I, along with several TJG team members, had the great privilege and fun of hosting clients and friends of the firm on the evening of September 12 at our annual Oktoberfest-themed Portfolios and Pints. The focus of our presentation was “questions from the hat” where we answered questions we’re hearing regularly from clients and advisors. While I don’t have the scope to be able to summarize everything we covered, I want to focus on a few questions that seem to be on the top of most everyone’s minds.

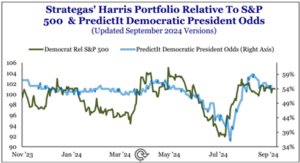

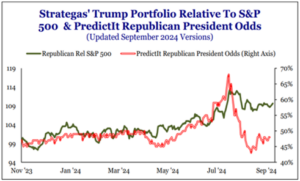

One question we received was, “What impact will the election have on markets?” As polls and betting markets all seem to indicate a very tight race between former President Trump and Vice President Harris, the types of stocks expected to do well under a Trump or Harris administration look very different. A Democrat-led White House is expected to be a tailwind for consumer companies (think retailers, food, restaurants), home builders, defense stocks, and solar companies. A Republican-led White House is expected to boost banks, telecommunications companies, materials companies (think steel, paper, etc.) and emerging markets stocks outside of China. A research firm we have long followed has constructed “baskets” of stocks that fall into either of these two categories and the performance has been striking. As the odds of a Democrat win fell through the early summer, the Democrat stock basket relative to the S&P 500 began to underperform while the Republican stock basket relative to the S&P 500 began outperforming. As the race began tightening in August, the two baskets have largely been trendless, reflecting the reality of a close race. We don’t know the outcome of the election, but if history is our guide and policy differences make a difference, we think this is a good way to view the election’s impact on markets.

Source: Strategas

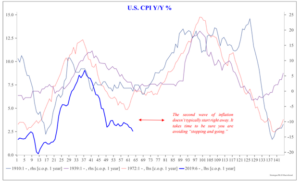

Another question that was asked was simply what our views were on the likelihood of another wave of inflation, a deflationary environment, or stagflation. First, a quick primer on terms is in order. We all know what inflation is, of course. Deflation is simply a decline in the consumer price index. Deflation has been very rare in the last several decades though it was more common in the 1800s and early 1900s. Stagflation is a period of inflation accompanied with sluggish or negative economic growth, last observed in the 1970s. A deflationary environment is, to us, improbable. Stagflation, too. Economic growth is still meaningfully positive and with significant amounts of government deficit spending, likely to continue. That leaves us with another wave of inflation as the most likely of the three scenarios. In prior inflationary environments, as seen in the chart below, inflation has come in waves.

Source: Stragegas

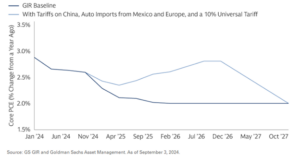

What makes us think this is possible looking into 2025 and beyond? For anyone who tuned into this week’s Presidential debate, both candidates are proposing policies that are likely to be inflationary. On the Republican side, a significant increase in tariffs could be a reason for an increase in inflation. Goldman Sachs estimates that core inflation (what the Fed focuses on) is likely to meander between 2.5% and 3% over the next couple of years if former President Trump is elected. You can see in the chart below that this is modestly higher than their baseline, “no tariff” scenario.

Source: Goldman Sachs

And while we don’t have a chart to highlight the impact, Vice President Harris’s proposal to provide aid to first time home buyers in the form of a $25,000 credit is likely to spur additional inflation in housing, which has been at the center of the longer-than-expected decline in inflation we’re experiencing today.

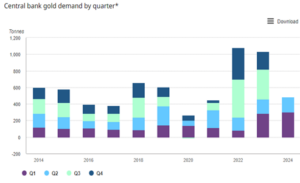

Finally, we received a question on what is going on with gold, and what impact might central banks be having on its price. We spent some time discussing why central banks buy gold – it tends to be for the very same reasons individuals and portfolio managers do it: it is seen as a store of value, a crisis-risk investment, and a way to diversify portfolios. Central banks are really leaning into those reasons as of late, with 2022 and 2023 being banner years for central bank purchases of gold and 2024 off to a record start.

Source: World Gold Council

This is just a sampling of the things we covered at our event, but hopefully it is representative of some of the big questions people have about markets right now. We’re always happy to address those as they come up, so please don’t hesitate to reach out to us with any questions you may have.

Written by Alex Durbin, CFA, Chief Investment Officer