Questions We Didn’t Get to Answer Last Night

September 15, 2023

To Inform:

Last night we held our annual Oktoberfest Portfolios and Pints event. Friends filled the big room upstairs at the Hofbräuhaus as Alex and I drew questions out of a hat, and I deflected as many complicated questions as I could for Alex to answer. Topics we discussed ranged from economic indicators (side note: the crowd last night does NOT believe we will see a recession in the next twelve months), diversified portfolios vs. the highest money market rates we have seen in years, and the potential risk from the dollar from an expanded currency union. We also handled several impromptu questions ranging from the UAW strike to how we may leverage the community of Joseph Group clients and friends to further benefit one another (side note: we will continue to talk about this one – great feedback).

While we covered a lot of ground last night, there were still a lot of questions left over in the hat at the end of the evening so Alex and I thought we would go back to the hat and try to answer a few more this morning in this issue of WealthNotes.

Q: What’s the cheapest area of the market?

My (Travis) quick answer to this one and something we have talked about a lot in TJG’s Investment Committee is small cap U.S. stocks. Small company stocks haven’t enjoyed the same degree of rally as their larger company brethren and as a result, the relative performance of small caps relative to large caps is the lowest it has been in over 20 years.

Source: Bloomberg

One more chart looks at valuation through the lens of price to book ratios – the blue line at the bottom reflects the cheapness of small company stocks.

Source: Bloomberg

The wide gap in valuation between large and small stocks resonates with me because the last time it happened to this degree was in the early 2000’s, after the bursting of the “tech bubble.” I was a young portfolio manager at the time and remember the early 2000’s seeing a multi-year leadership run for small company stocks.

Now, to be fair, small company stocks tend to be more economically sensitive than large caps, so timing of leadership could be rough if we see an economic slowdown. That said, in a recent article, Doug Ramsey, Chief Investment Officer at The Leuthold Group recently said, “if we do a see a slowdown in the economy and stocks correct, it could present a generational buying opportunity for small company stocks.”

Q: Will we see a government shutdown this fall?

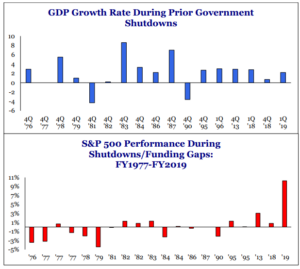

Alex says, “thanks for letting me take this one Travis.” We wouldn’t be surprised to see a government shutdown in the coming weeks as both parties in D.C. squabble over issues such as immigration enforcement and spending levels. In the context of the recent downgrade to US government debt, this is unwelcome news. That said, government shutdowns are not new, with 20 of them occurring since 1976 and the last coming in 2019. The average length of a government shutdown is 8 days, with some lasting just a day while 2019’s took 34 days to resolve.

Historically, the impact of a government shutdown has had limited impact on economic growth and stock market performance. At the margins, a shutdown does reduce growth, but this is typically recouped in the following months. In quarters where government shutdowns have occurred in the past, just two of them saw GDP decline.

S&P 500 performance is a mixed bag, with mild declines in some episodes and positive performance in others. Oddly enough, the 2019 shutdown saw S&P 500 performance of nearly +10%. These things considered, we’re not too concerned about a government shutdown given the likelihood of resolution and historical evidence that they seem to have only mild impacts on the economy and markets.

Source: Strategas Research Partners

Q: Is the Federal Reserve done hiking rates?

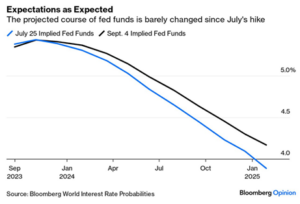

We talked a bit about the economy last night, but I don’t think we hit this question directly. The Fed meets next week and when they announce their decision on interest rates on September 20th, according to CME Fed Watch, there is currently a 97% chance the Fed will leave interest rates unchanged. The November meeting is a little more in question with 35% odds of one more hike and 65% odds of again leaving rates unchanged.

We aren’t big conspiracy theorists, but there is some buzz in the financial world that when Wall Street Journal Reporter Nick Timiraos writes, it pays to listen. A number of financial insiders believe Timiraos’ ear is attuned to the Fed and he is helping control their media narrative. An article last week reinforced the idea of “broad agreement to hold interest rates unchanged in September” and his comments about “cooling inflation” and “the burden on evidence to show an accelerating economy” lead many to believe we have already seen the final rate hike.

The chart below shows the current expected path for short-term interest rates based on Fed Funds futures. With the caveat that forecasts are always subject to change, the market is pricing in rate cuts to begin in early 2024, and for short-term rates to be as much as 1% lower a year from now.

Source: Bloomberg

Clients and friends, thank you for the privilege of engaging in dialogue as we seek to figure out this crazy financial world together. We’re planning a Portfolios at Your Place Zoom event at the end of October and look forward to continuing the conversation.

Written by Travis Upton, Partner, CEO and Chief Investment Officer

Written by Travis Upton, Partner, CEO and Chief Investment Officer

Alex Durbin, Portfolio Manager

Alex Durbin, Portfolio Manager