Return of the Cyclicals

April 8, 2021

To Inform:

Cyclical stocks are found across a range of sectors and are those most tied to changes in the broader economy. They’re often in the front row seat for any sort of economic slowdown (e.g., homebuilders and banks in 2008-09), but can be one of the better ways to play a strengthening economy. While some cyclicals end up casualties of economic contractions, others are simply ignored by the market only to be rediscovered when earnings begin to pick up.

We’re seeing this today in a number of places. Earlier this week, ETFs that track industrial companies, home construction, and basic materials hit relative highs against the S&P 500 they hadn’t seen in more than a decade. The terms we often see accompanying these types of moves include “base building” and “breakout”. The “base building” is the long period in which a company or sector may be ignored by the market. During this time period companies are innovating, cleaning up balance sheets, and generally improving operations. Eventually the market realizes this and sends shares in a stock or sector experiencing this kind of improvement higher. This is the “breakout”.

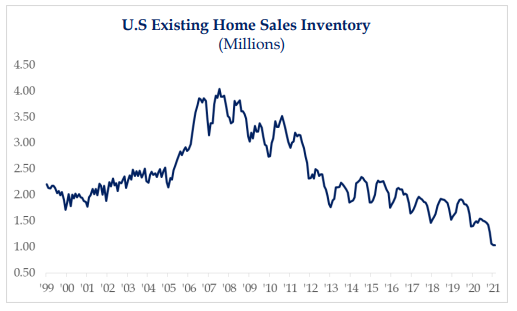

Starting with homebuilders, it is widely known that the residential real estate market is tight. In fact, there are now more real estate agents in the United States than there are homes for sale! Existing home inventory nationwide is down 75% from its peak in 2007. Population growth leads to an average of over a million new households per year. Homebuilders, smarting from the housing crisis of the late 2000s spent years “building a base”. Cleaning out inventory and repairing balance sheets took priority over expansion. With cleaned up balance sheets, high consumer demand, and record low interest rates, home builders face one of the more attractive markets for new construction in a long time.

Source: Strategas

Industrial companies’ performance is closely tied to fixed investment made by companies. The chart below from the St. Louis Federal Reserve Bank shows the trend in quarterly fixed investment over the last 50 years. Investment troughed in 2010, recovered, but didn’t grow for several years. COVID interrupted what appeared to be a recovery in investment that began in the late 2010s. As we begin to distance ourselves from the worst of the COVID-19 pandemic, companies across the US may regain the confidence to invest in industrial equipment, which would be an obvious tailwind for the sector.

Source: Federal Reserve Bank of St. Louis

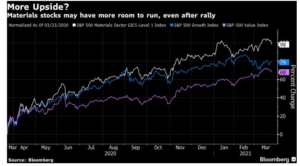

Materials companies – think chemical companies, container and packaging companies, metals and mining companies, and construction companies – are naturally sensitive to changes in the economic environment. Clearing post-COVID skies and significant policy shifts towards infrastructure investment bode well for this sector. What’s more, a rotation to value stocks and a weaker dollar also present tailwinds for materials companies as their goods are usually priced in dollars. Bloomberg recently reported on the recovery in the materials sector and notes that despite outperforming the S&P 500 from the lows of last March, the sector could have more upside.

Source: Bloomberg

An old boss of mine used to repeat the mantra that in the investment business, “everything’s cyclical”. It’s easy when your favorite stock or sector is out of style to forget this, but it really is good advice. As we look to “break out” from the COVID-19 induced economic shock, the time for cyclicals to shine looks like a strong possibility.

Written by Alex Durbin, Portfolio Manager