Revisiting the Bond Math in 2025

January 10, 2025

To Inform:

Early in 2023 we talked about why it was a better time to own bonds than it had been in years prior, especially 2022, the worst year on record for bond returns. That indeed was the case in 2023 as investment grade bond indexes were up a little more than 5% and high yield bonds were up more than 13%. But what about 2024 and is it the case still today that owning bonds is a worthwhile proposition?

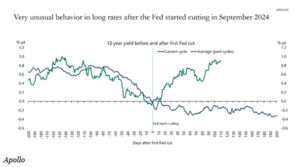

As many expected, the Federal Reserve began cutting the Fed Funds rate in 2024, lowering it by 1% from September to year-end. What many did not expect is that long-term interest rates would not follow the typical pattern observed when the Fed begins cutting short-term rates. The chart below shows the movement in the interest rate in the US 10-year treasury bond in the 200 days leading up to the first cut and the 200 days following the first cut. Typically, the 10-year treasury rate begins falling even before the Fed cuts short term rates. In fact, most of the decline occurs in this period. After Fed cuts, rates tend to fall a little more but not by as much. In 2024, 10-year treasury rates fell throughout the year into the first cut in September. But, unlike past cycles, have risen substantially since then.

Source: Bloomberg

Why Haven’t Rates Fallen?

You might be thinking, “Shouldn’t rates fall if the Federal Reserve is cutting rates?” The answer is yes, but only the rates the Federal Reserve controls. The Federal Reserve has little to no control over long-term interest rates but does control short-term interest rates. The reason rates haven’t followed the typical pattern is because the economy isn’t showing the kind of behavior it typically shows around Federal Reserve interest rate cutting cycles.

In many past instances, the economy began slowing during the leadup to a cutting cycle and continued slowing throughout. That hasn’t been the case this time around. Growth was solid and consistently above expectations in 2024, and we see that continuing into 2025. Today’s monthly non-farms payroll report is just the latest example of resilient economic strength. Employers added 256,000 jobs last month, ahead of the 155,000 estimate. Adding to this is the fear of still uncontained inflation. The Federal Reserve, still licking their wounds from the inflationary shock in 2021 and 2022, fears a resurgence in inflation and is likely to proceed with caution in 2025 before further rate cuts.

Are Bonds Still Worth Owning?

So, what does this all mean for bonds? Well, in 2024 it meant for somewhat of an up and down year. Right around the time of the Fed’s first cut, an investment grade bond index was up over 5% on the year. But, as long-term rates went higher in the 4th quarter, these gains were wiped out, with the index up only about 1.5% in 2024. High Yield bonds, less subject to these movements in interest rates were up a little over 8% on the year. In all, a mixed bag for bonds.

Despite this mixed bag in 2024, we remain relatively optimistic about bonds in 2025, and feel like for the patient investor, the coupons they pay are worth the ups and downs in interest rates. Right now, investment grade bonds in the US yield just under 5%. Long-term municipal bonds (think tax free) yield a little over 4%, and high yield bonds are paying coupons of around 7.5%. Furthermore, if the economy slows and rates fall even a little bit, the reward to bond investors could be meaningful.

The table below shows what happens to a variety of bond types across three different scenarios: rates down 1%, rates flat, and rates up 1%. As we often mention, bond prices have a teeter-totter-like relationship with interest rates. When rates go down, bond prices go up and vice-versa. If rates fall by 1% many areas of the bond market could provide total returns of more than 10%, with few much below even 8%. This, we think, is an attractive risk/reward landscape for bond investors.

Source: JPMorgan

As you review the last year and maybe scratch your head at the recent performance in bonds, our hope is that this piece might help you understand the “why” behind recent bond market performance and the “what” that undergirds the case for one to continue to hold bonds going forward. Despite these near-term hiccups, for clients with diversified investment portfolios and long-term return targets in the mid-single digits, the ups and downs in bonds over the last couple of years sure beat the low interest rates of the last decade!

Written by Alex Durbin, CFA, Chief Investment Officer