RUST is de-FANGing the Market

August 12, 2016

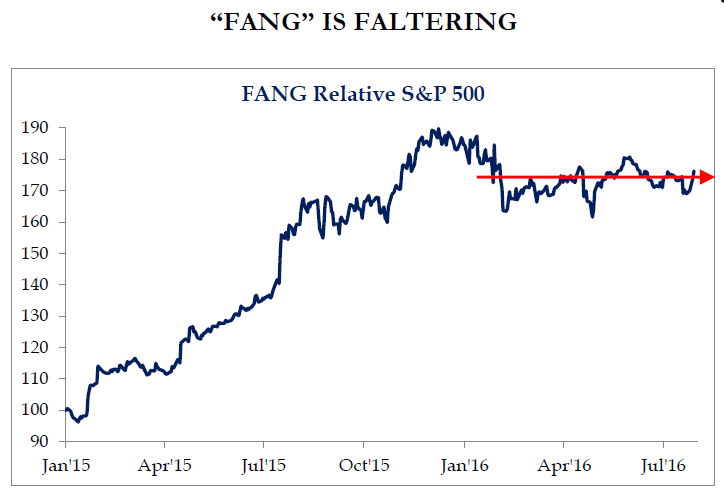

In 2015, the average U.S. stock was down about -4 to -5%, but a few large technology stocks significantly outperformed the broader market. These big outperformers were known as “FANG” – Facebook, Amazon, Netflix, and Google.

Despite their outperformance in 2015, this year the FANG stocks are showing that chasing recent momentum is not necessarily a winning strategy. Collectively the four “FANG” stocks have tread water versus the S&P 500 so far in 2016.

Source: Strategas Research Partners

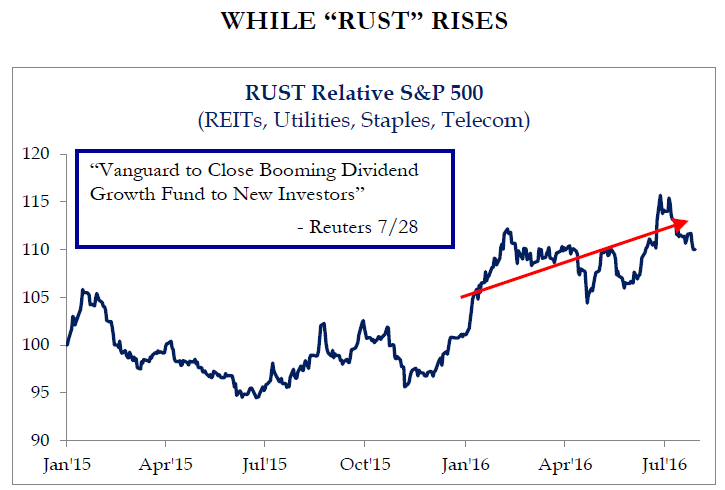

This year, under a backdrop of low interest rates, leadership is coming from high dividend paying stocks. The new acronym for this year’s market leadership is “RUST” – REITs (Real Estate Investment Trusts), Utilities, Staples (consumer staples), and Telecom.

Last year, the performance of Morningstar’s Large Value category was -4.05%, but so far in 2016, “value” stocks, especially those with high dividend yields, are leading the market higher. As interest rates have continued to fall, investors have looked to dividend paying stocks as an attractive place to earn income from their investments.

Source: Strategas Research Partners

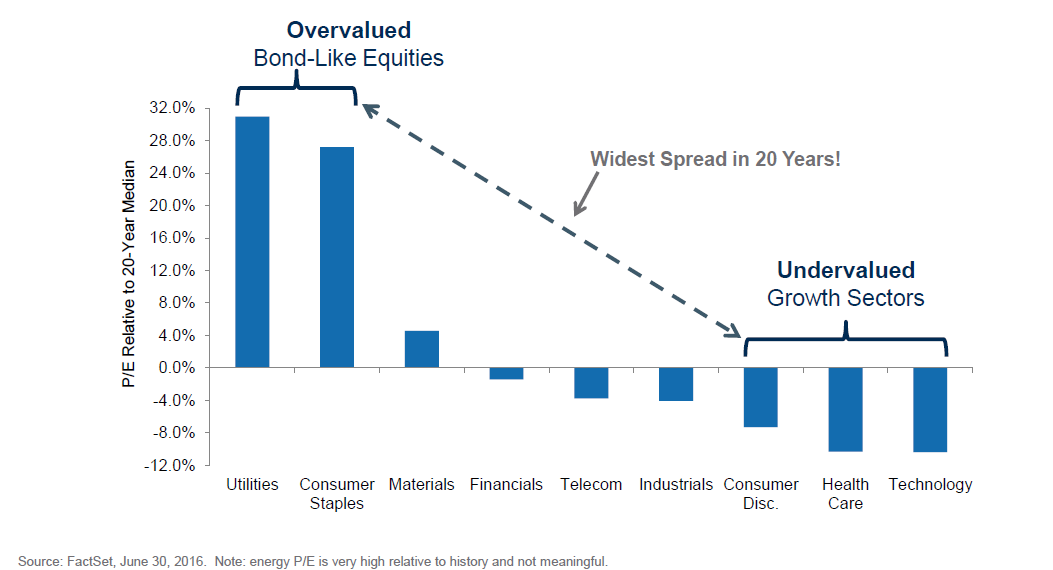

In The Joseph Group’s investment committee meetings, one of the key questions we are asking is “Will the RUST leadership continue?” Looking at valuations, there is reason to question whether “RUST” can continue to lead the market higher. Relative to their median P/E (price to earnings) ratio, Utilities and Consumer Staples stocks are trading at their most expensive levels in 20 years. On the other hand, sectors which have been weak in 2016, including health care and technology, are trading at P/E levels below their historical average.

Source: Alger Capital Management/FactSet

It may take an increase in interest rates for market leadership to shift again, but when it comes to valuations, there is risk that FANG may bite back against the RUST.