Sales, Margins, Buybacks…Oh My!

July 27, 2018

To Inform:

We are in the early stages of second-quarter earnings announcements in the U.S., and things are looking positive. In order to grow earnings every year, there are really three levers a company can pull:

- Revenue Growth – is the company growing their sales numbers?

- Margin Expansion – is the company reducing costs and/or taxes?

- Stock Buybacks – is the company’s profit being spread across a fewer number of shareholders?

Over the past few years, the financial media has spent a lot of time claiming “companies aren’t actually growing their earnings, they’re just manipulating things by buying back shares!” This makes it seem like companies are manipulating their earnings rather than growing organically, but is this claim really true?

Source: JPMorgan Asset Management

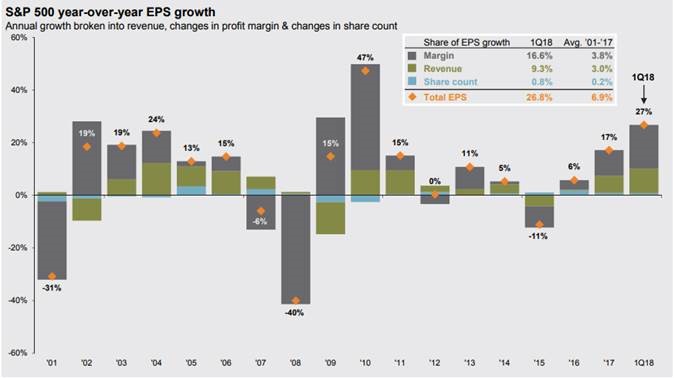

A recent report by JPMorgan Asset Management studied each of the three components (revenue growth, margin expansion, and share buybacks) to S&P 500 Index earnings growth over the past 17 years. The chart above shows this visually – the gray bar represents margin expansion, the green bar represents revenue growth, and the blue bar represents share buybacks.

As shown in this chart, JPMorgan found revenue growth and margin expansion have historically been the primary drivers of earnings growth. In other words, a company is best able to grow earnings by selling more goods and keeping costs low, while share buybacks have not added much to this growth.

Looking at the beginning of this year, company earnings have grown about 27% between the first quarter of 2017 and the first quarter of 2018. Breaking this number down to the three components show the following:

- Revenue Growth: +9.3%. Sales grew at the highest year over year rate in over five years!

- Margin Expansion: +16.6%. Costs include taxes. A lower corporate tax rate has already started to impact company earnings.

- Share Buybacks: +0.8%. Stock buybacks contributed to earnings growth, but not as much as the first two.

Again, a large percentage of earnings growth was driven by sales growth and improving profit margins – not necessarily companies buying back stock. It seems intuitive and simple, and it is, but it may not make for an interesting news headline!