Secure Act 2.0

January 27, 2023

To Inform:

While we gathered with family, friends, and loved ones just a few weeks ago for the holiday season the U.S. Congress passed the Consolidated Appropriations Act of 2023. Although this Appropriations Act is largely a spending bill gaining notoriety for its $1.7 trillion price tag, it includes legislation within it known as “Secure Act 2.0.” This “2.0 Act” further builds upon the original Secure Act passed in 2019. As a reminder “SECURE” is the acronym for Setting Every Community Up for Retirement Enhancement. Combined, both Secure Acts provide sweeping legislation aimed at increasing access to retirement plan savings, streamlining retirement reporting requirements, and preserving retirement income for U.S. households. This most recent legislation was officially signed into law on December 29, 2022.

The Secure Act 2.0 is quite extensive for both retirement plans and Individuals having greater reaching implications than that of the original Secure Act. It is so expansive that it implements changes beginning in 2023 continuing through 2028. For now, let’s examine the significant changes being implemented in 2023:

Changes to Required Minimum Distributions (RMD)

- Individuals who have already begun taking their RMD will continue “as is” and there are no changes.

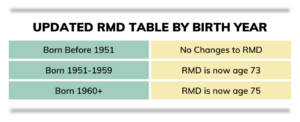

- Individuals who have not yet begun their RMD will now take their first one the year in which they turn 73. The original Secure Act had increased the RMD to age 72, so if you turn 72 in 2023, you will now delay your initial RMD until 2024.

- Taking your first RMD at age 73 will be effective for those turning 73 between 2023 and 2032.

- Beginning in 2033 Individuals will not be required to take their first RMD until the age of 75.

Penalty for Missing a Required Minimum Distribution

- The penalty for not satisfying the RMD shortfall is reduced from 50% to 25%. It can be reduced to 10% by acting during a “correction window.” This means acting by no later than the end of the second year after the RMD shortfall occurred.

Company Matching Retirement Plan Contributions: 401(k), 403(b) and 457(b) Plans

- Provided that the Employer has adopted it within their company’s retirement plan, employer matching contributions can now be made to participant Roth accounts. This is not required but can serve as an option for retirement plans which provide a match to their employees.

- Any Employer Roth contributions will be for matching and non-elective contributions only. Company profit sharing contributions are not eligible to be Roth contributions.

- The Participant will recognize any matching Roth contribution as taxable income in the year it is contributed but then grows tax-free under Roth rules.

SEP and Simple IRA Plan Contributions

- Beginning in 2023 contributions up to the annual limits can now be made in Roth dollars for both SEP and Simple IRA accounts. Previously the SEP and Simple IRA did not allow Roth contributions.

- To allow these types of contributions Employers must modify their plan documents allowing Roth funds to be contributed before they can become effective.

As the Secure Act 2.0 was passed very late in calendar year 2022 there are just a few changes for 2023. However, they can be significant especially for those who were to begin their RMD and those who now have additional savings opportunities via Roth contributions. As mentioned, there will be rolling implementations across various calendar years for both Employers and Employees forthcoming.

We love helping our clients achieve their own individual goals so they can live a great life. If there are further questions on this topic or others about how we can best help your individual wealth planning needs, please reach out to your Joseph Group Client Advisor.

Written by Jeff Tudor, Client Advisor & Team Lead