Seeing Life from Small Cap Stocks

October 17, 2025

To Inform:

Stock market performance over the last few years has favored large technology stocks but in recent months we have seen some life in small company stocks (companies generally under $3 billion in size), and it has our attention.

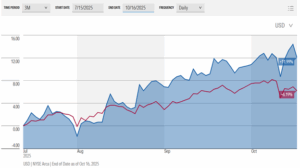

With the caveat three months does not make a long-term trend, here is a chart of the performance over the last three months between the Russell 2000 (small cap stock) Index (blue line) and the S&P 500 (red line). As you can see, small caps have been on a tear since late August.

Source: Morningstar

Early this year, small company stocks trailed larger companies, but the recent performance surge has allowed small cap performance to catch up and so far for 2025, large and small cap stock performance is running neck and neck. What has our attention though are comments from analysts about a potential “shift in leadership.” Strategas technical analyst Chris Verrone goes as far as to state, “small versus large company leadership is at an 8-month high and favors small cap stocks as we head into year end.”

So, the big question – is Verrone right? Is the performance leadership of small company stocks something which can continue? Here are three key data points we are looking at:

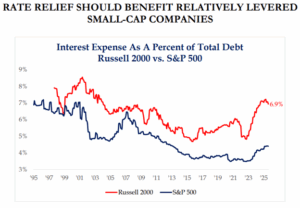

Fed Rate Cuts May Favor Small Companies

The chart below shows small companies (Russell 2000 – red line) pay more interest as a percentage of total debt than larger companies. While this relationship is unlikely to change, future Fed rate cuts are likely to benefit smaller companies more than larger companies. Since the market tends to move more based on “better or worse” than “good or bad,” rate cuts favor making things better for small company stocks.

Source: Strategas Research Partners

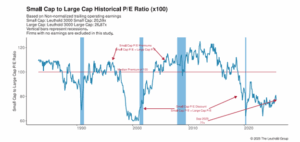

Small Company Stocks Remain Relatively Cheap vs. Large Company Stocks

The chart below looks at the relationship in valuation (price to earnings) of small company stocks versus large company stocks. The way to read the chart is that when the line is high, small cap stocks are relatively expensive and when the line is low (like today) small cap stocks are relatively cheap. Valuation can be a poor timing tool, and small cap stocks have been “relatively cheap” for years, but if leadership is shifting, small stocks have a lot of potential runway to catch up to the bigger companies. We saw it happen in the 2000 – 2010 period and it could happen again.

Source: The Leuthold Group

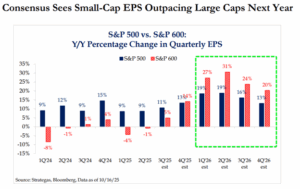

Earnings Estimates Favor Small Cap Earnings Growth

Consensus earnings estimates are supportive of stock market fundamentals – analysts believe corporate earnings will continue to grow. What’s interesting though is that analysts are projecting earnings for small company stocks to grow faster than earnings for large company stocks in 2026. Remember our important adage that the market tends to move more based on “better or worse” than “good or bad?” Here is another case where the news overall (positive earnings) is good, but if analyst expectations prove to be even in the realm of correct, the news is “better” for small company stocks.

Source: Strategas Research Partners

It’s too early to say we are entering a phase of small cap leadership, and we echo our earlier comment that three months does not make a trend. We have seen performance pops out of small cap stocks before, only to see it fizzle. That said, we believe continued technical leadership, plus fundamental support from interest rates, valuation, and earnings support the case for including small cap stocks within client stock allocations.

Each of the diversified portfolio strategies we have the privilege of managing for clients currently contains an allocation to small company stocks, using different funds/ETFs within different portfolios consistent with the objective of each strategy. We are not increasing those allocations yet, but doing so is likely to be a hot topic in our Investment Strategy Team meetings as we head into year end.

Written by Travis Upton, Partner and CEO