Sell in May? Weighing the Pros and Cons for the Market

May 3, 2024

To Inform:

As the calendar has turned to May the trees are leafing out, the flowers are blooming, and market prognosticators are trotting out one of their favorite nostrums that perhaps you’ve heard of – “Sell in May and Go Away.” Are the prognosticators right, does this make sense? We’ll look at the historical data and then take a trip through the current pros and cons affecting the stock market and you can be the judge!

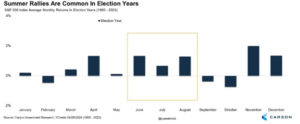

While market returns are often strong late in the year (Santa Claus rallies) and the start of a new calendar year, returns in the middle of the year are nothing to sneeze at. According to Fundstrat Research, the month of May itself has been positive 77% of the time in the last 40 years. Broadening out, in election years, the middle of the year has historically been a time where markets string together some of their best returns, with June, July, and August all positive on average.

Source: Carson Investment Research

Alright, enough history, what about this year? Any individual year can deviate from the average and do so for specific reasons. Follow along as we key in on a few “pros” about today’s market and highlight a few “cons” or risks to the market backdrop.

Beginning with the pros, let’s start with earnings season. Now a few weeks in, we’ve seen good news from the blue chip stocks we’re all familiar with. As of the beginning of this week, all 11 sectors of the S&P 500 are beating analyst’s estimates for earnings per share. When looking at any sector under the hood there have been the usual misses, but more than 80% of companies are beating earnings estimates.

Source: Raymond James

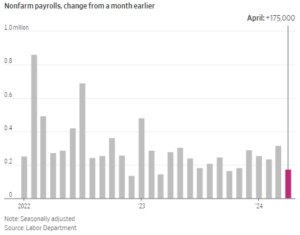

Another pro in today’s market is the continued health in the labor market. While today’s report was short of expectations, the economy still added 175,000 jobs in April and unemployment sits at 3.9%. A major positive included in the report and one that is key in the inflation fight was the moderation in wage growth, with wages up 3.9% year over year.

Source: WSJ

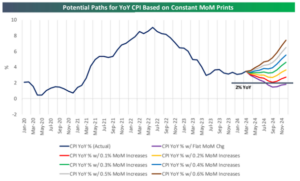

Turning to the cons in the market, concerns have risen over the string of stubborn inflation reports thus far in 2024 and the concomitant rise in interest rates. The chart below shows the decline seen in 2023 has flattened out, and the spaghetti lines show the potential paths forward based on future inflation reports. In order to get to the Fed’s target of 2%, the coming months need to show flat (purple line) to only slightly positive (red line) month over month increases in inflation. Recently we’ve seen much warmer monthly numbers, in the range of 0.3 to 0.4% (green and blue lines).

Source: Bespoke Investment Group

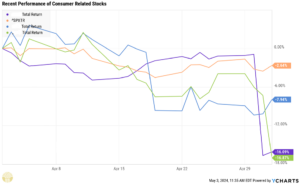

While names have been removed from the chart below to protect the innocent, recent performance of stocks geared towards the consumer has been disappointing. Consumers are doing less streaming, buying less coffee, and ordering less takeout as inflation fatigue and some belt tightening is taking place, especially across lower tiers of the income distribution. Several companies have made note of the struggles facing low-income consumers in recent earnings reports. This could be a near term blip, but it’s something to watch if inflation continues surprising to the upside.

Source: YCharts

Hopefully you can see that simply selling in May and “going away” is never that easy. Historically, it has been advice with mixed performance, and as a result it behooves us to understand some of the key drivers of market data today to make an informed decision. Weighing the pros and cons and applying our own judgment, the Investment Committee at TJG when surveyed last week gave a nod to the market pros and maintained current stock allocations in client portfolios, believing that earnings strength and a healthy labor market can overcome the risks associated with inflation and a tired consumer in the months ahead.

Written by Alex Durbin, CFA, Chief Investment Officer