Short-Term Interest Rates – The Rest of the Story

May 19, 2023

To Inform:

As the end of the school year approaches, the Upton house has had a busy week of choir concerts. Two of my kids are in their school choirs and this week alone we have three concerts to attend. That’s a lot of music! At the first concert I was sitting next to my father-in-law and he leaned over and said to me: “I hadn’t been paying attention, but I saw something that said you could buy a short-term investment and make over 5%! Is that true and are we getting in on that?” Doing what I do, I really wanted to give an explanation of the mechanics of the short-term bond market right now, but the music started, and I wasn’t able to. Fortunately, there is WealthNotes!

As I type, the interest rate on a 1-month Treasury bill is 5.5%. WOW! I have a historical chart in front of me which goes back 20 years, and the current rate is the highest on the chart. So, is this a huge opportunity? Well, maybe. I’ll explain.

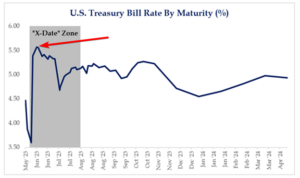

Below is a chart of current Treasury bill rates by maturity over the next year. Notice the highest rate is 1-month rate for the T-bill which matures in June. Also notice this rate is in the gray shaded “X-date” Zone.

Source: Strategas Research Partners, with Travis drawing an arrow

The “X-Date” Zone refers to the estimated time period where Congress must act to raise the “debt ceiling” – the self-imposed limit on borrowing (similar to a credit card limit) for the United States. While the debt ceiling has been raised numerous times (78 times since 1960…we keep borrowing), the current negotiations are politically contentious with both Republicans and Democrats wanting certain concessions before coming to an agreement.

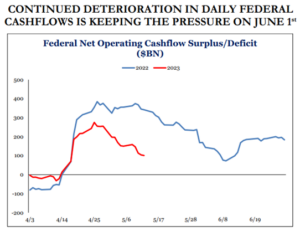

All the political wrangling is happening with a clock ticking…if Congress does not come to an agreement to increase the debt ceiling before the U.S. Government runs out of cash, the Government may not be able to make interest payments on debt or pay workers to operate government services. As you can see from the chart below, Federal cash flow this year is trending weaker than it did last year, which means the “X-date” of the government running out of cash could happen in the next two weeks.

Source: Strategas Research Partners

So, what does all of this have to do with the short-term interest rate? It is virtually unfathomable Congress will not raise the debt ceiling at some point, but the big question is whether it will happen before the X-date of the Government running out of cash. If not, the Government may not be able to make payments (such as on debt maturing in June) until Congress approves the ability for the Government to borrow more money to replenish its cash account. We believe the reason the 1-month T-bill rate is so much higher is because the market is pricing in the risk the Government may not pay off the 1-month T-bill at maturity. Depending on Congress, it may take a few weeks for investors to get their money back and reinvest those funds. In other words, while the 5.5% T-bill rate looks strong to quite strong on the surface, the additional interest may not be a free lunch.

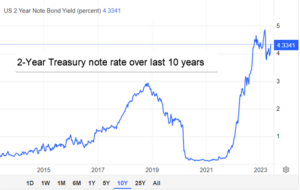

So, how are we handling the short-term interest rate market for strategic cash we have the privilege to manage for clients? One of the portfolio tools we use which seeks to meet the goal of protecting capital (over periods longer than 1 year) is a strategy called Conservation. We focus on short-term bonds in Conservation but own a range of maturities in the portfolio which could go out as far as 3-4 years. Let’s look at the 2-year Treasury as a proxy.

The chart below shows the 2-year Treasury note is 4.33% as of 5/19…that’s a full percentage point lower than the 1-month rate! Isn’t that a bad deal? Well, not necessarily…

Source: Tradingeconomics.com

The 1-month rate is annualized which means to earn that rate over a full year, you would have to reinvest at that rate over the 12-month period. We’d say that does not look likely and if you add the additional complication that it may take a few extra weeks to get your principal back to reinvest because of the debt ceiling – the math simply looks next to impossible.

On the other hand, the 2-year note income rate is locked in for two years, and mathematically, if rates go down more than the market expects, there is even the potential for price appreciation in the longer-term bond (teeter-totter – market rates down, bond prices up).

Bottom line, even though the “sticker rate” on the 1-month T-bill is higher, if you have concerns about the economy and the debt ceiling and market interest rates decline in the months ahead, buying a 2-year note at the lower rate could actually result in the higher total return.

I really wanted to tell my father-in-law all of this at Wednesday night’s choir concert, but I couldn’t. Fortunately, we have another concert tonight and as my middle school son is on stage, hopefully I can get him to read this and see if he notices my ‘Meet the Parents’ joke.

Have a great weekend!

Written by Travis Upton, Partner, CEO and Chief Investment Officer