Should I Invest When Markets Are Up?

February 2, 2024

To Inform:

“The market’s up, should I go to cash?” seems to be a question we hear a lot when, well, the market is up. As I was pondering what to write about this week, my thoughts went to this question. Confirming my choice of topic was a 401(k) participant who stopped by our office this morning to ask that exact question! So, let’s dig in. When the market has been on a nice run, should we take profits?

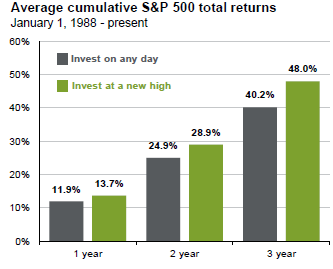

With the usual caveat that past performance doesn’t guarantee future results, I thought the chart we saw from JPMorgan this week was interesting. The data here is simple. JPMorgan tested how investors would have fared on a cumulative performance basis if they had invested on any day since 1/1/1988. The average performance 1 year out was 11.9%, and by 3 years out their cumulative performance was 40.2%. From there, JPMorgan then asked, “what if investors invested on days where the market hit new highs?”. This will be a smaller sample size because here JPMorgan isn’t looking at every day, but only days the market reached a new high. This smaller but still large sample size yields an interesting result – the average performance 1, 2, and 3 years out was higher when investing at new highs than investing on any day.

Source: JPMorgan Asset Management

I enjoy America’s pastime as much as any other sport and a phrase I’ve always liked is “hitting begets hitting.” It’s hard to describe why, but if you like baseball you can probably remember games where your favorite team is pouring on hits and runs in a show of offensive power. Some people might chalk this up to a pitcher having a bad day. And maybe that’s true some of the time. I think something else could be at work, some sort of momentum effect. I’ll leave my theorizing about baseball and momentum for the Moneyball types to find an answer to this. One area where momentum is highly studied and better understood is in financial markets.

The concept of momentum in markets has been discussed over the years by academics and practitioners alike. One practitioner calls momentum “one of the most powerful forces in markets”. The case for momentum is often explained as a behavioral phenomenon. These behaviors include herding (lots of investors doing the same thing), overreaction to news (either good or bad), and confirmation bias (only looking at information that supports our case). When investors are displaying these behaviors in spades, they can do so for a long time, and markets can go on an impressive run.

We’d be more worried about this momentum if there was a litany of bad news that markets were simply ignoring. But with recent data on employment, productivity, and GDP growth, we think there’s a supportive backdrop for markets for the time being. In our view, the answer to the question posed at the beginning of this article is not “go to cash!”. It’s what I shared with a plan participant this morning: be mindful that in markets the “trend can be your friend” and that now is an excellent time to review your investment allocation and your financial plan. It may for planning reasons make a good deal of sense to reallocate your assets. But let that be what drives your decision making, not the fact that markets have been doing well lately!

Written by Alex Durbin, CFA , Chief Investment Officer