Should I Stay or Should I Go?

July 11, 2023

To Inform:

41 years ago, when the UK punk rock band The Clash released their most famous single, 30-year fixed mortgage rates here stateside were 16.7%. While current mortgage rates are not remotely close to those of 1982, many would-be movers are still echoing the line so artfully sung by Mick Jones.

In that angsty British punk tone, Mick laments, “if I go there will be trouble, if I stay it will be double.” For our purposes, we will flip Mick’s dilemma. If a homeowner stays, there will be the trouble of not getting the next home they want or need. If they go, their mortgage rate may double. Okay, we’ve stretched that far enough.

Per the chart below, current 30-year fixed mortgage rates are about 6.8%. Many who bought a home or refinanced a mortgage in 2020 or 2021 have a rate of 3% or less, which makes a move to a new home cost prohibitive. While it may not be comforting when the monthly check is written, we must keep in mind that, historically, rates are still below the long-term average.

Source: FreddieMac

For those “stuck” in their home with a low rate, even a lateral move from a home-price perspective may increase the monthly payment substantially. For example, a 30-year, $300,000 mortgage at an interest rate of 3% has a monthly principal and interest payment of $1,265. That same mortgage at 6.8% has a payment of $1,956. Paying nearly $700 more per month at the same value would seem to be a non-starter. That’s the bad news. Better news incoming…

You may have heard the phrase “marry the house, date the rate.” This highlights that if rates come down in the near future, there could be an opportunity to refinance at a lower rate. While not a guarantee, it’s an arrow in the quiver to make a new home more affordable down the road. Rates are not likely to come back to 3% any time soon, but even a small decrease can save tens of thousands over the life of a loan.

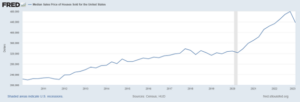

Another boon for potential movers who already own a home is that median sales prices of houses sold have nearly doubled since 2010, as illustrated in the chart below. I know, you’re still buying into the same market from which you’re selling but having a large chunk of change in your pocket can help to either lower your principal amount or buy down the interest rate on a new mortgage.

Source: fred.stlouisfed.org

Well, should I stay or should I go? Whether you’re downsizing later in life or looking for that dream home in which to raise your family, don’t let the perfect be the enemy of the good. Talk to your financial planner and you may find your next home is not “always tease, tease, tease.” Then you’ll be able to declare when that home hits the market, “if you say that you are mine, I’ll be here ‘till the end of time.”

Written by Nick Boyden, Client Advisor