Silver Linings

October 7, 2022

To Inform:

Markets have dealt a difficult hand of cards this year. Equity returns have been subpar nearly across the board (energy being the sole standout) and bonds, typically the ballast in rough seas, have performed almost as poorly as equities. The question on everyone’s mind is “Are there any positives in today’s market?” Before attempting to answer that question, let’s first start with a look at returns on the “60/40” portfolio. The “60/40” portfolio is a portfolio with a 60% allocation to the S&P 500 and a 40% allocation to the Bloomberg US Aggregate Bond Index. There have been several other years in the last several decades with negative returns to this portfolio, but those all saw large selloffs in stocks. Nineteen ninety-four is the only other down year in the 60/40 since the late 1970s in which bonds were negative.

Source: The Leuthold Group

When does the pain end in bonds? It may in fact already be over. The chart below shows the link between starting yields in 10-Year US Treasury Bonds and subsequent 10-year returns in US Treasury Bonds. The blue line, starting yields, moves closely with the orange line, the 10-year returns. We began the year with 10-Year Treasuries under 2% and have recently approached 4%. The Bloomberg US Aggregate Bond Index, a mix of US Treasuries and investment grade corporate bonds sports a starting yield of close to 4.5% today. While further rises in interest rates could impact bond returns in a negative way, the impact of a much more meaningful yield cushion would lessen the blow. If recession risks accelerate, bond yields are likely to fall, leading to positive price return while still providing decent income. In portfolios we have the privilege of managing for clients we have steadily increased exposure to bonds this year, as bond investors are now being compensated for the risk they’re taking (a rarity in the last dozen or so years!).

Source: A Wealth of Common Sense

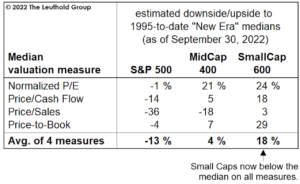

Stocks are much more difficult to handicap. Here, unlike in bonds, returns are less driven by math and driven much more by sentiment and headlines. The “math” investors can use to at least get things directionally right is valuations. Here, the news looks a lot better than it did at the beginning of the year. The Leuthold Group, one of our research partners and a fund manager we use in many client portfolios, does regular valuation work to help investors get a handle on possible paths forward. In a recent note they showed current valuations in large cap, mid cap, and small cap stocks relative to a handful of valuation measures. The definitions of these measures are beyond the scope of this note, but it’s interesting to see that relative to long-term medians, future downside potential for large cap stocks is limited. Even more encouraging is the reality that mid cap and small cap stocks are actually trading below their long-term median valuations.

Source: The Leuthold Group

The “directional” signals that stock valuations provide us must be caveated by the fact that investor behavior often causes stocks to overshoot both to the upside and the downside. The rip-roaring rallies of 2020 and 2021 were perhaps overdone. Stocks could behave in a similar way to the downside, but eventually the bad news gets priced in, and markets stage a recovery. One of the biggest challenges in investing is seeing past the short-term pain and looking for reasons for optimism. Today, a great place to look is the higher starting yields on bonds and more reasonable stock valuations.

Written by Alex Durbin, Portfolio Manager